It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 24.4% during the first 9 months of 2019 and outperformed the S&P 500 ETF by 4 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards Crocs, Inc. (NASDAQ:CROX) changed during the first quarter.

Is Crocs, Inc. (NASDAQ:CROX) a cheap investment today? Money managers are getting less optimistic. The number of bullish hedge fund bets decreased by 4 recently. Our calculations also showed that CROX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the fresh hedge fund action regarding Crocs, Inc. (NASDAQ:CROX).

Hedge fund activity in Crocs, Inc. (NASDAQ:CROX)

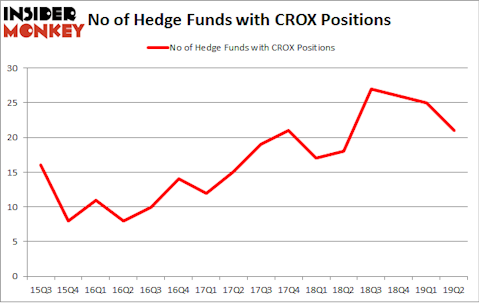

At the end of the second quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -16% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CROX over the last 16 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in Crocs, Inc. (NASDAQ:CROX) was held by Renaissance Technologies, which reported holding $76.1 million worth of stock at the end of March. It was followed by Woodson Capital Management with a $55.6 million position. Other investors bullish on the company included D E Shaw, Marshall Wace LLP, and Arrowstreet Capital.

Since Crocs, Inc. (NASDAQ:CROX) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of hedgies who were dropping their positions entirely by the end of the second quarter. At the top of the heap, Lee Ainslie’s Maverick Capital dumped the biggest position of all the hedgies followed by Insider Monkey, totaling about $19.8 million in stock. Richard Driehaus’s fund, Driehaus Capital, also said goodbye to its stock, about $18.2 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 4 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks similar to Crocs, Inc. (NASDAQ:CROX). These stocks are Bed Bath & Beyond Inc. (NASDAQ:BBBY), Bloom Energy Corporation (NYSE:BE), Cray Inc. (NASDAQ:CRAY), and Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA). This group of stocks’ market valuations are closest to CROX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBBY | 20 | 288496 | -9 |

| BE | 11 | 29807 | 2 |

| CRAY | 25 | 167546 | 6 |

| LOMA | 14 | 16776 | 7 |

| Average | 17.5 | 125656 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $126 million. That figure was $345 million in CROX’s case. Cray Inc. (NASDAQ:CRAY) is the most popular stock in this table. On the other hand Bloom Energy Corporation (NYSE:BE) is the least popular one with only 11 bullish hedge fund positions. Crocs, Inc. (NASDAQ:CROX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CROX as the stock returned 40.6% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.