The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Cree, Inc. (NASDAQ:CREE) and find out how it is affected by hedge funds’ moves.

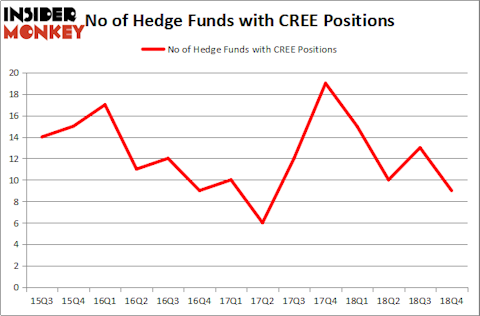

Is Cree, Inc. (NASDAQ:CREE) an outstanding stock to buy now? The best stock pickers are in a bearish mood. The number of long hedge fund positions decreased by 4 in recent months. Our calculations also showed that CREE isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s review the fresh hedge fund action regarding Cree, Inc. (NASDAQ:CREE).

What have hedge funds been doing with Cree, Inc. (NASDAQ:CREE)?

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -31% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in CREE a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Among these funds, Iridian Asset Management held the most valuable stake in Cree, Inc. (NASDAQ:CREE), which was worth $175.5 million at the end of the third quarter. On the second spot was Columbus Circle Investors which amassed $29.9 million worth of shares. Moreover, Citadel Investment Group, Polar Capital, and PEAK6 Capital Management were also bullish on Cree, Inc. (NASDAQ:CREE), allocating a large percentage of their portfolios to this stock.

Due to the fact that Cree, Inc. (NASDAQ:CREE) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of fund managers that elected to cut their full holdings by the end of the third quarter. Interestingly, Chuck Royce’s Royce & Associates sold off the largest position of the “upper crust” of funds followed by Insider Monkey, worth an estimated $5.3 million in stock. David Harding’s fund, Winton Capital Management, also sold off its stock, about $5.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 4 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cree, Inc. (NASDAQ:CREE) but similarly valued. We will take a look at Empire State Realty Trust Inc (NYSE:ESRT), Knight-Swift Transportation Holdings Inc. (NYSE:KNX), Genesee & Wyoming Inc (NYSE:GWR), and AGCO Corporation (NYSE:AGCO). This group of stocks’ market values resemble CREE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESRT | 13 | 160283 | 0 |

| KNX | 26 | 299335 | -5 |

| GWR | 18 | 322177 | 7 |

| AGCO | 32 | 238888 | 11 |

| Average | 22.25 | 255171 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $227 million in CREE’s case. AGCO Corporation (NYSE:AGCO) is the most popular stock in this table. On the other hand Empire State Realty Trust Inc (NYSE:ESRT) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Cree, Inc. (NASDAQ:CREE) is even less popular than ESRT. Hedge funds clearly dropped the ball on CREE as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CREE as the stock returned 57.6% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.