We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of CoreCivic, Inc. (NYSE:CXW).

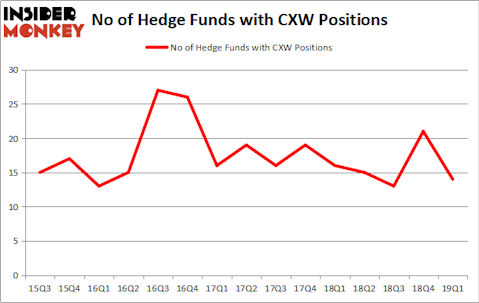

CoreCivic, Inc. (NYSE:CXW) has seen a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that CXW isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are viewed as underperforming, old financial tools of the past. While there are more than 8000 funds trading at present, Our experts choose to focus on the elite of this club, around 750 funds. Most estimates calculate that this group of people command bulk of the smart money’s total capital, and by observing their finest equity investments, Insider Monkey has come up with many investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a peek at the fresh hedge fund action regarding CoreCivic, Inc. (NYSE:CXW).

How have hedgies been trading CoreCivic, Inc. (NYSE:CXW)?

At the end of the first quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -33% from the fourth quarter of 2018. By comparison, 16 hedge funds held shares or bullish call options in CXW a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in CoreCivic, Inc. (NYSE:CXW), which was worth $57.9 million at the end of the first quarter. On the second spot was Capital Growth Management which amassed $31.4 million worth of shares. Moreover, Millennium Management, Two Sigma Advisors, and Arrowstreet Capital were also bullish on CoreCivic, Inc. (NYSE:CXW), allocating a large percentage of their portfolios to this stock.

Since CoreCivic, Inc. (NYSE:CXW) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there exists a select few fund managers that slashed their positions entirely heading into Q3. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the biggest stake of the “upper crust” of funds monitored by Insider Monkey, comprising about $4.3 million in stock, and Cristan Blackman’s Empirical Capital Partners was right behind this move, as the fund said goodbye to about $3.9 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 7 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to CoreCivic, Inc. (NYSE:CXW). These stocks are SVMK Inc. (NASDAQ:SVMK), Welbilt, Inc. (NYSE:WBT), Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA), and Applied Industrial Technologies (NYSE:AIT). This group of stocks’ market valuations resemble CXW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SVMK | 20 | 538478 | 9 |

| WBT | 27 | 852150 | 4 |

| IBA | 3 | 35097 | 0 |

| AIT | 17 | 109689 | -3 |

| Average | 16.75 | 383854 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $384 million. That figure was $145 million in CXW’s case. Welbilt, Inc. (NYSE:WBT) is the most popular stock in this table. On the other hand Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA) is the least popular one with only 3 bullish hedge fund positions. CoreCivic, Inc. (NYSE:CXW) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on CXW as the stock returned 22.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.