Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Canopy Growth Corporation (NYSE:CGC)? The smart money sentiment can provide an answer to this question.

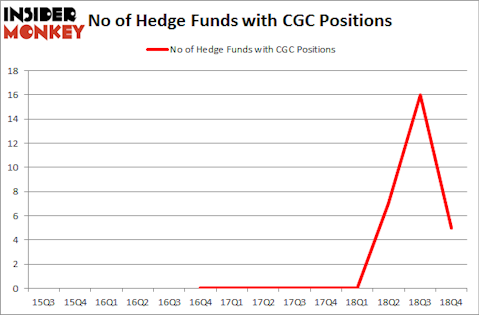

Is Canopy Growth Corporation (NYSE:CGC) a buy here? Hedge funds are taking a bearish view. The number of bullish hedge fund positions retreated by 11 lately. Our calculations also showed that CGC isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are perceived as underperforming, outdated investment vehicles of yesteryear. While there are over 8000 funds with their doors open at the moment, We choose to focus on the elite of this club, approximately 750 funds. These hedge fund managers control most of all hedge funds’ total capital, and by paying attention to their unrivaled stock picks, Insider Monkey has come up with various investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the fresh hedge fund action surrounding Canopy Growth Corporation (NYSE:CGC).

How have hedgies been trading Canopy Growth Corporation (NYSE:CGC)?

At Q4’s end, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of -69% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in CGC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Canopy Growth Corporation (NYSE:CGC) was held by Citadel Investment Group, which reported holding $17.4 million worth of stock at the end of September. It was followed by D E Shaw with a $9.5 million position. Other investors bullish on the company included OZ Management, Two Sigma Advisors, and Berylson Capital Partners.

Since Canopy Growth Corporation (NYSE:CGC) has experienced a decline in interest from the smart money, it’s safe to say that there lies a certain “tier” of hedge funds that slashed their full holdings in the third quarter. Interestingly, James Crichton’s Hitchwood Capital Management sold off the biggest position of the 700 funds monitored by Insider Monkey, totaling close to $21.9 million in stock, and Kenneth Tropin’s Graham Capital Management was right behind this move, as the fund dumped about $19.5 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 11 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Canopy Growth Corporation (NYSE:CGC). These stocks are Autohome Inc (NYSE:ATHM), BanColombia S.A. (NYSE:CIB), Macy’s, Inc. (NYSE:M), and AGNC Investment Corp. (NASDAQ:AGNC). This group of stocks’ market values are closest to CGC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATHM | 14 | 774200 | -4 |

| CIB | 6 | 86233 | 1 |

| M | 30 | 857420 | 1 |

| AGNC | 21 | 407136 | 6 |

| Average | 17.75 | 531247 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $531 million. That figure was $29 million in CGC’s case. Macy’s, Inc. (NYSE:M) is the most popular stock in this table. On the other hand BanColombia S.A. (NYSE:CIB) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Canopy Growth Corporation (NYSE:CGC) is even less popular than CIB. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on CGC as the stock returned 70.7% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.