At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

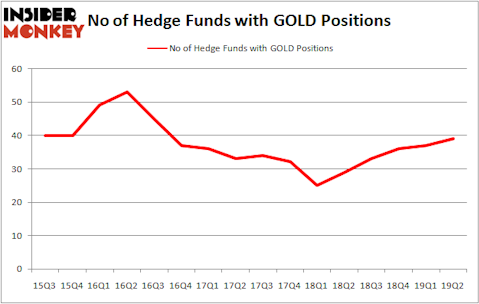

Barrick Gold Corporation (NYSE:GOLD) was in 39 hedge funds’ portfolios at the end of June. GOLD has seen an increase in hedge fund sentiment lately. There were 37 hedge funds in our database with GOLD holdings at the end of the previous quarter. Our calculations also showed that GOLD isn’t among the 30 most popular stocks among hedge funds.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the fresh hedge fund action regarding Barrick Gold Corporation (NYSE:GOLD).

How have hedgies been trading Barrick Gold Corporation (NYSE:GOLD)?

At the end of the second quarter, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GOLD over the last 16 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

The largest stake in Barrick Gold Corporation (NYSE:GOLD) was held by Slate Path Capital, which reported holding $195.8 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $177.4 million position. Other investors bullish on the company included Adage Capital Management, Odey Asset Management Group, and Citadel Investment Group.

As aggregate interest increased, key money managers have been driving this bullishness. Duquesne Capital, managed by Stanley Druckenmiller, initiated the most outsized position in Barrick Gold Corporation (NYSE:GOLD). Duquesne Capital had $62.8 million invested in the company at the end of the quarter. Wayne Cooperman’s Cobalt Capital Management also made a $5.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Sara Nainzadeh’s Centenus Global Management, Mike Vranos’s Ellington, and Minhua Zhang’s Weld Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Barrick Gold Corporation (NYSE:GOLD) but similarly valued. We will take a look at Sirius XM Holdings Inc (NASDAQ:SIRI), Cummins Inc. (NYSE:CMI), Coca-Cola European Partners plc (NYSE:CCEP), and CRH PLC (NYSE:CRH). This group of stocks’ market caps match GOLD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIRI | 29 | 1238935 | -3 |

| CMI | 45 | 1127412 | 3 |

| CCEP | 10 | 133381 | -3 |

| CRH | 7 | 78961 | 2 |

| Average | 22.75 | 644672 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $645 million. That figure was $1163 million in GOLD’s case. Cummins Inc. (NYSE:CMI) is the most popular stock in this table. On the other hand CRH PLC (NYSE:CRH) is the least popular one with only 7 bullish hedge fund positions. Barrick Gold Corporation (NYSE:GOLD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on GOLD as the stock returned 10.1% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.