The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Array Biopharma Inc (NASDAQ:ARRY).

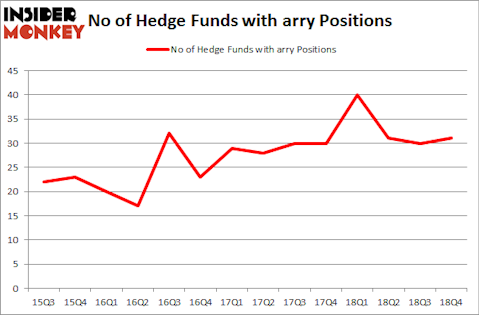

Array Biopharma Inc (NASDAQ:ARRY) was in 31 hedge funds’ portfolios at the end of the fourth quarter of 2018. ARRY has experienced an increase in hedge fund sentiment in recent months. There were 30 hedge funds in our database with ARRY holdings at the end of the previous quarter. Our calculations also showed that arry isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are seen as slow, old financial vehicles of yesteryear. While there are greater than 8000 funds trading today, We hone in on the elite of this club, about 750 funds. These investment experts handle bulk of the smart money’s total capital, and by paying attention to their first-class stock picks, Insider Monkey has discovered many investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a look at the recent hedge fund action surrounding Array Biopharma Inc (NASDAQ:ARRY).

What does the smart money think about Array Biopharma Inc (NASDAQ:ARRY)?

At the end of the fourth quarter, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from one quarter earlier. By comparison, 40 hedge funds held shares or bullish call options in ARRY a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Redmile Group, managed by Jeremy Green, holds the biggest position in Array Biopharma Inc (NASDAQ:ARRY). Redmile Group has a $234.5 million position in the stock, comprising 9.4% of its 13F portfolio. The second largest stake is held by Point72 Asset Management, led by Steve Cohen, holding a $93.2 million position; 0.5% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions consist of Thomas Steyer’s Farallon Capital, Julian Baker and Felix Baker’s Baker Bros. Advisors and Mark Lampert’s Biotechnology Value Fund / BVF Inc.

Consequently, key money managers have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, assembled the most valuable position in Array Biopharma Inc (NASDAQ:ARRY). Point72 Asset Management had $93.2 million invested in the company at the end of the quarter. Jeffrey Jay and David Kroin’s Great Point Partners also initiated a $26.4 million position during the quarter. The other funds with new positions in the stock are Oleg Nodelman’s EcoR1 Capital, Steve Cohen’s Point72 Asset Management, and Howard Marks’s Oaktree Capital Management.

Let’s go over hedge fund activity in other stocks similar to Array Biopharma Inc (NASDAQ:ARRY). We will take a look at First Hawaiian, Inc. (NASDAQ:FHB), Investors Bancorp, Inc. (NASDAQ:ISBC), BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), and Belmond Ltd (NYSE:BEL). This group of stocks’ market valuations resemble ARRY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FHB | 21 | 276809 | -7 |

| ISBC | 27 | 650714 | -6 |

| BJ | 16 | 233292 | -16 |

| BEL | 20 | 334659 | 4 |

| Average | 21 | 373869 | -6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $374 million. That figure was $787 million in ARRY’s case. Investors Bancorp, Inc. (NASDAQ:ISBC) is the most popular stock in this table. On the other hand BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Array Biopharma Inc (NASDAQ:ARRY) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ARRY as the stock returned 56.6% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.