At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

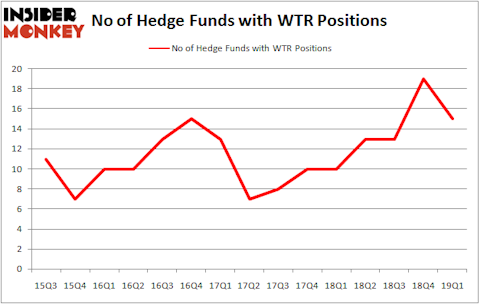

Is Aqua America Inc (NYSE:WTR) a cheap stock to buy now? The best stock pickers are getting less optimistic. The number of long hedge fund bets were trimmed by 4 recently. Our calculations also showed that WTR isn’t among the 30 most popular stocks among hedge funds.

Today there are many formulas investors have at their disposal to analyze their stock investments. Some of the most useful formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can trounce the market by a solid margin (see the details here).

We’re going to view the latest hedge fund action encompassing Aqua America Inc (NYSE:WTR).

What have hedge funds been doing with Aqua America Inc (NYSE:WTR)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in WTR a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Impax Asset Management held the most valuable stake in Aqua America Inc (NYSE:WTR), which was worth $97.7 million at the end of the first quarter. On the second spot was Royce & Associates which amassed $15.9 million worth of shares. Moreover, AQR Capital Management, D E Shaw, and Two Sigma Advisors were also bullish on Aqua America Inc (NYSE:WTR), allocating a large percentage of their portfolios to this stock.

Because Aqua America Inc (NYSE:WTR) has faced declining sentiment from the smart money, it’s safe to say that there exists a select few fund managers that elected to cut their full holdings heading into Q3. Interestingly, Clint Carlson’s Carlson Capital cut the largest position of the 700 funds tracked by Insider Monkey, valued at close to $11.7 million in stock, and Jonathan Barrett and Paul Segal’s Luminus Management was right behind this move, as the fund cut about $8.3 million worth. These moves are important to note, as total hedge fund interest was cut by 4 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Aqua America Inc (NYSE:WTR). We will take a look at Pool Corporation (NASDAQ:POOL), Phillips 66 Partners LP (NYSE:PSXP), KT Corporation (NYSE:KT), and Ultrapar Participacoes SA (NYSE:UGP). This group of stocks’ market caps resemble WTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| POOL | 16 | 248823 | -1 |

| PSXP | 4 | 9165 | -2 |

| KT | 19 | 267347 | 3 |

| UGP | 12 | 60086 | 9 |

| Average | 12.75 | 146355 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $146 million. That figure was $139 million in WTR’s case. KT Corporation (NYSE:KT) is the most popular stock in this table. On the other hand Phillips 66 Partners LP (NYSE:PSXP) is the least popular one with only 4 bullish hedge fund positions. Aqua America Inc (NYSE:WTR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on WTR as the stock returned 14.8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.