At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

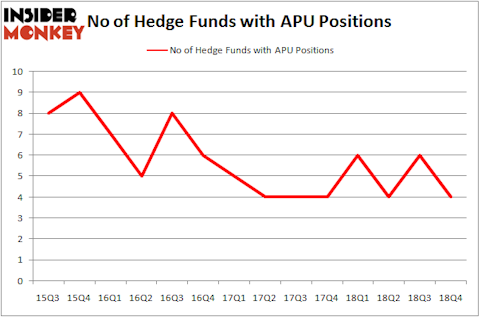

AmeriGas Partners, L.P. (NYSE:APU) investors should be aware of a decrease in support from the world’s most elite money managers lately. Our calculations also showed that APU isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to check out the recent hedge fund action regarding AmeriGas Partners, L.P. (NYSE:APU).

What have hedge funds been doing with AmeriGas Partners, L.P. (NYSE:APU)?

At Q4’s end, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of -33% from the second quarter of 2018. By comparison, 6 hedge funds held shares or bullish call options in APU a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Arrowstreet Capital was the largest shareholder of AmeriGas Partners, L.P. (NYSE:APU), with a stake worth $9.4 million reported as of the end of September. Trailing Arrowstreet Capital was Renaissance Technologies, which amassed a stake valued at $6.3 million. PEAK6 Capital Management, McKinley Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that AmeriGas Partners, L.P. (NYSE:APU) has faced a decline in interest from the smart money, logic holds that there lies a certain “tier” of funds that elected to cut their full holdings in the third quarter. At the top of the heap, John A. Levin’s Levin Capital Strategies dumped the largest position of all the hedgies followed by Insider Monkey, valued at an estimated $0.3 million in stock. Frederick DiSanto’s fund, Ancora Advisors, also sold off its stock, about $0 million worth. These moves are important to note, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as AmeriGas Partners, L.P. (NYSE:APU) but similarly valued. We will take a look at TC Pipelines, LP (NYSE:TCP), TerraForm Power Inc (NASDAQ:TERP), Tegna Inc (NYSE:TGNA), and Retail Properties of America Inc (NYSE:RPAI). This group of stocks’ market values match APU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCP | 2 | 4806 | -2 |

| TERP | 8 | 192144 | -6 |

| TGNA | 22 | 309181 | -1 |

| RPAI | 15 | 175160 | 1 |

| Average | 11.75 | 170323 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $18 million in APU’s case. Tegna Inc (NYSE:TGNA) is the most popular stock in this table. On the other hand TC Pipelines, LP (NYSE:TCP) is the least popular one with only 2 bullish hedge fund positions. AmeriGas Partners, L.P. (NYSE:APU) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on APU as the stock returned 44.9% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.