Is American International Group Inc (NYSE:AIG) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

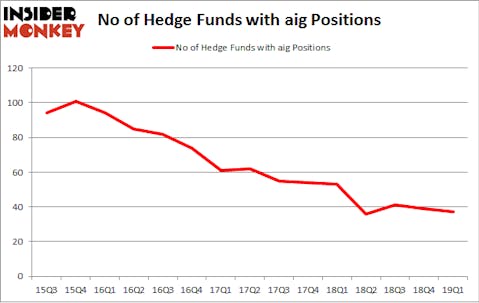

American International Group Inc (NYSE:AIG) was in 37 hedge funds’ portfolios at the end of the first quarter of 2019. AIG shareholders have witnessed a decrease in support from the world’s most elite money managers lately. There were 39 hedge funds in our database with AIG holdings at the end of the previous quarter. Our calculations also showed that aig isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action surrounding American International Group Inc (NYSE:AIG).

How have hedgies been trading American International Group Inc (NYSE:AIG)?

At the end of the first quarter, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the fourth quarter of 2018. On the other hand, there were a total of 53 hedge funds with a bullish position in AIG a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, First Pacific Advisors LLC was the largest shareholder of American International Group Inc (NYSE:AIG), with a stake worth $662.4 million reported as of the end of March. Trailing First Pacific Advisors LLC was Pzena Investment Management, which amassed a stake valued at $529.8 million. Diamond Hill Capital, Adage Capital Management, and First Pacific Advisors LLC were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that American International Group Inc (NYSE:AIG) has witnessed falling interest from the smart money, logic holds that there lies a certain “tier” of funds who sold off their entire stakes by the end of the third quarter. It’s worth mentioning that Brian J. Higgins’s King Street Capital cut the biggest position of the “upper crust” of funds watched by Insider Monkey, totaling close to $15.4 million in stock, and Farhad Nanji and Michael DeMichele’s MFN Partners was right behind this move, as the fund said goodbye to about $15.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as American International Group Inc (NYSE:AIG) but similarly valued. These stocks are Koninklijke Philips NV (NYSE:PHG), ICICI Bank Limited (NYSE:IBN), Fidelity National Information Services Inc. (NYSE:FIS), and The Travelers Companies Inc (NYSE:TRV). All of these stocks’ market caps resemble AIG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHG | 11 | 158586 | -3 |

| IBN | 26 | 744012 | 0 |

| FIS | 55 | 3479314 | 18 |

| TRV | 29 | 1262157 | 0 |

| Average | 30.25 | 1411017 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $1411 million. That figure was $1793 million in AIG’s case. Fidelity National Information Services Inc. (NYSE:FIS) is the most popular stock in this table. On the other hand Koninklijke Philips NV (NYSE:PHG) is the least popular one with only 11 bullish hedge fund positions. American International Group Inc (NYSE:AIG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on AIG as the stock returned 20.6% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.