We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. That’s a big deal.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

AbbVie Inc (NYSE:ABBV) has seen an increase in enthusiasm from smart money in recent months. Our calculations also showed that ABBV isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a multitude of indicators shareholders employ to appraise stocks. A couple of the less utilized indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best fund managers can outclass the market by a healthy amount (see the details here).

John Overdeck of Two Sigma Advisors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the recent hedge fund action surrounding AbbVie Inc (NYSE:ABBV).

Hedge fund activity in AbbVie Inc (NYSE:ABBV)

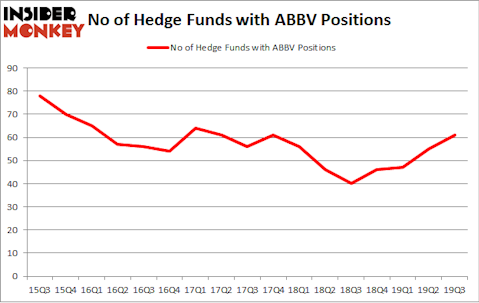

Heading into the fourth quarter of 2019, a total of 61 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ABBV over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Orbis Investment Management held the most valuable stake in AbbVie Inc (NYSE:ABBV), which was worth $1304.3 million at the end of the third quarter. On the second spot was Arrowstreet Capital which amassed $565.2 million worth of shares. Renaissance Technologies, Two Sigma Advisors, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Orbis Investment Management allocated the biggest weight to AbbVie Inc (NYSE:ABBV), around 9.63% of its portfolio. Copernicus Capital Management is also relatively very bullish on the stock, dishing out 9.3 percent of its 13F equity portfolio to ABBV.

As aggregate interest increased, key money managers were leading the bulls’ herd. Farallon Capital created the most valuable position in AbbVie Inc (NYSE:ABBV). Farallon Capital had $75.7 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $57.4 million investment in the stock during the quarter. The other funds with brand new ABBV positions are Brian Ashford-Russell and Tim Woolley’s Polar Capital, Stephen DuBois’s Camber Capital Management, and Frank Brosens’s Taconic Capital.

Let’s go over hedge fund activity in other stocks similar to AbbVie Inc (NYSE:ABBV). We will take a look at Lockheed Martin Corporation (NYSE:LMT), Broadcom Inc (NASDAQ:AVGO), BHP Group (NYSE:BBL), and Eli Lilly and Company (NYSE:LLY). This group of stocks’ market values are similar to ABBV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMT | 46 | 1782982 | -2 |

| AVGO | 54 | 2515014 | 1 |

| BBL | 21 | 970915 | 1 |

| LLY | 41 | 1489505 | -2 |

| Average | 40.5 | 1689604 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.5 hedge funds with bullish positions and the average amount invested in these stocks was $1690 million. That figure was $4435 million in ABBV’s case. Broadcom Inc (NASDAQ:AVGO) is the most popular stock in this table. On the other hand BHP Group (NYSE:BBL) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks AbbVie Inc (NYSE:ABBV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on ABBV as the stock returned 17.6% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.