Stocks, especially the once high flying technology stocks, had a lousy start to the new year. QQQ lost 9% of its value in January. We aren’t certain about the bubbly technology stocks that trade for ridiculously high multiples of their revenues, but we believe top hedge fund stocks will deliver positive returns for the rest of the year. In this article, we will take a closer look at hedge fund sentiment towards The Mosaic Company (NYSE:MOS) at the end of the third quarter and determine whether the smart money was really smart about this stock.

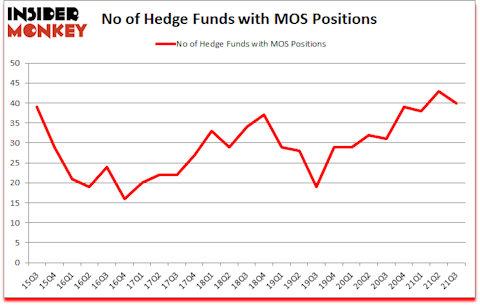

The Mosaic Company (NYSE:MOS) was in 40 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 43. MOS shareholders have witnessed a decrease in hedge fund interest of late. There were 43 hedge funds in our database with MOS positions at the end of the second quarter. Our calculations also showed that MOS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind let’s take a glance at the latest hedge fund action regarding The Mosaic Company (NYSE:MOS).

Do Hedge Funds Think MOS Is A Good Stock To Buy Now?

At third quarter’s end, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the second quarter of 2021. By comparison, 31 hedge funds held shares or bullish call options in MOS a year ago. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

More specifically, Platinum Asset Management was the largest shareholder of The Mosaic Company (NYSE:MOS), with a stake worth $137.1 million reported as of the end of September. Trailing Platinum Asset Management was Slate Path Capital, which amassed a stake valued at $118.2 million. Adage Capital Management, AQR Capital Management, and Appaloosa Management LP were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Brightline Capital allocated the biggest weight to The Mosaic Company (NYSE:MOS), around 10.47% of its 13F portfolio. Slate Path Capital is also relatively very bullish on the stock, dishing out 5.4 percent of its 13F equity portfolio to MOS.

Due to the fact that The Mosaic Company (NYSE:MOS) has experienced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there is a sect of hedgies that slashed their full holdings by the end of the third quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management dumped the biggest stake of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $25.5 million in stock, and Simon Sadler’s Segantii Capital was right behind this move, as the fund cut about $21.7 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to The Mosaic Company (NYSE:MOS). These stocks are Vail Resorts, Inc. (NYSE:MTN), Suzano S.A. (NYSE:SUZ), GameStop Corp. (NYSE:GME), Howmet Aerospace Inc. (NYSE:HWM), Futu Holdings Limited (NASDAQ:FUTU), Citrix Systems, Inc. (NASDAQ:CTXS), and WestRock Company (NYSE:WRK). This group of stocks’ market caps are closest to MOS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTN | 40 | 644916 | 0 |

| SUZ | 6 | 47280 | 2 |

| GME | 9 | 80933 | -9 |

| HWM | 44 | 3495496 | -3 |

| FUTU | 23 | 664044 | -8 |

| CTXS | 24 | 766516 | 1 |

| WRK | 34 | 719952 | 2 |

| Average | 25.7 | 917020 | -2.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.7 hedge funds with bullish positions and the average amount invested in these stocks was $917 million. That figure was $913 million in MOS’s case. Howmet Aerospace Inc. (NYSE:HWM) is the most popular stock in this table. On the other hand Suzano S.A. (NYSE:SUZ) is the least popular one with only 6 bullish hedge fund positions. The Mosaic Company (NYSE:MOS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MOS is 74.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on MOS as the stock returned 12.1% since the end of Q3 (through 1/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Mosaic Co (NYSE:MOS)

Follow Mosaic Co (NYSE:MOS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best REIT Stocks to Buy Right Now

- 10 Best Gun Stocks to Invest In

- 15 Beginner Country Guitar Songs that are Fun and Easy to Play

Disclosure: None. This article was originally published at Insider Monkey.