We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Intercontinental Exchange Inc (NYSE:ICE) and determine whether hedge funds skillfully traded this stock.

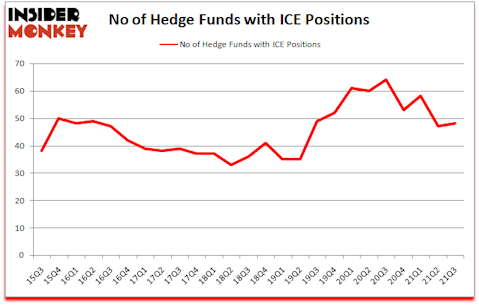

Is Intercontinental Exchange Inc (NYSE:ICE) a safe investment now? Prominent investors were betting on the stock. The number of long hedge fund bets moved up by 1 recently. Intercontinental Exchange Inc (NYSE:ICE) was in 48 hedge funds’ portfolios at the end of September. The all time high for this statistic is 64. Our calculations also showed that ICE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s analyze the latest hedge fund action encompassing Intercontinental Exchange Inc (NYSE:ICE).

William Von Mueffling of Cantillon Capital Management

Do Hedge Funds Think ICE Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 48 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from one quarter earlier. By comparison, 64 hedge funds held shares or bullish call options in ICE a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Intercontinental Exchange Inc (NYSE:ICE) was held by Cantillon Capital Management, which reported holding $474.7 million worth of stock at the end of September. It was followed by Alkeon Capital Management with a $384.5 million position. Other investors bullish on the company included Ako Capital, Arrowstreet Capital, and D E Shaw. In terms of the portfolio weights assigned to each position Truvvo Partners allocated the biggest weight to Intercontinental Exchange Inc (NYSE:ICE), around 29.61% of its 13F portfolio. Crescent Park Management is also relatively very bullish on the stock, setting aside 5.5 percent of its 13F equity portfolio to ICE.

Consequently, specific money managers have jumped into Intercontinental Exchange Inc (NYSE:ICE) headfirst. Junto Capital Management, managed by James Parsons, created the most outsized position in Intercontinental Exchange Inc (NYSE:ICE). Junto Capital Management had $140.4 million invested in the company at the end of the quarter. Qing Li’s Sciencast Management also initiated a $2.8 million position during the quarter. The other funds with brand new ICE positions are Gregg Moskowitz’s Interval Partners, Gregg Moskowitz’s Interval Partners, and Ran Pang’s Quantamental Technologies.

Let’s now review hedge fund activity in other stocks similar to Intercontinental Exchange Inc (NYSE:ICE). These stocks are Bank of Montreal (NYSE:BMO), Aon plc (NYSE:AON), Colgate-Palmolive Company (NYSE:CL), Illumina, Inc. (NASDAQ:ILMN), Waste Management, Inc. (NYSE:WM), Autodesk, Inc. (NASDAQ:ADSK), and Banco Santander, S.A. (NYSE:SAN). This group of stocks’ market values resemble ICE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMO | 12 | 142342 | 0 |

| AON | 47 | 6005008 | -21 |

| CL | 54 | 2577652 | -4 |

| ILMN | 55 | 2801228 | 4 |

| WM | 36 | 3629155 | -3 |

| ADSK | 54 | 2356939 | -10 |

| SAN | 14 | 543799 | -3 |

| Average | 38.9 | 2579446 | -5.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.9 hedge funds with bullish positions and the average amount invested in these stocks was $2579 million. That figure was $2832 million in ICE’s case. Illumina, Inc. (NASDAQ:ILMN) is the most popular stock in this table. On the other hand Bank of Montreal (NYSE:BMO) is the least popular one with only 12 bullish hedge fund positions. Intercontinental Exchange Inc (NYSE:ICE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ICE is 70.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on ICE as the stock returned 10.6% since the end of Q3 (through 1/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Intercontinentalexchange Inc (NYSE:ICE)

Follow Intercontinentalexchange Inc (NYSE:ICE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Aggressive Stocks to Buy Now

- 10 Most Popular Finance Podcasts

- 15 Countries With The Highest Standard of Living in 2020

Disclosure: None. This article was originally published at Insider Monkey.