Stocks, especially the once high flying technology stocks, had a lousy start to the new year. QQQ lost 9% of its value in January. We aren’t certain about the bubbly technology stocks that trade for ridiculously high multiples of their revenues, but we believe top hedge fund stocks will deliver positive returns for the rest of the year. In this article, we will take a closer look at hedge fund sentiment towards CBRE Group, Inc. (NYSE:CBRE) at the end of the third quarter and determine whether the smart money was really smart about this stock.

Hedge fund interest in CBRE Group, Inc. (NYSE:CBRE) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that CBRE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Affirm Holdings, Inc. (NASDAQ:AFRM), Verisk Analytics, Inc. (NASDAQ:VRSK), and EPAM Systems Inc (NYSE:EPAM) to gather more data points.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to review the latest hedge fund action encompassing CBRE Group, Inc. (NYSE:CBRE).

David Blood of Generation Investment Management

Do Hedge Funds Think CBRE Is A Good Stock To Buy Now?

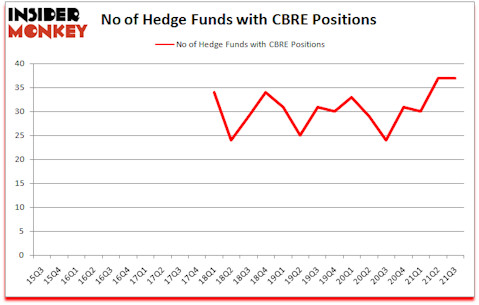

At third quarter’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CBRE over the last 25 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, ValueAct Capital was the largest shareholder of CBRE Group, Inc. (NYSE:CBRE), with a stake worth $898.9 million reported as of the end of September. Trailing ValueAct Capital was Generation Investment Management, which amassed a stake valued at $664.7 million. Cantillon Capital Management, Arrowstreet Capital, and Ariel Investments were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position ValueAct Capital allocated the biggest weight to CBRE Group, Inc. (NYSE:CBRE), around 10.41% of its 13F portfolio. Kerrisdale Capital is also relatively very bullish on the stock, designating 4.21 percent of its 13F equity portfolio to CBRE.

Because CBRE Group, Inc. (NYSE:CBRE) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedge funds that decided to sell off their entire stakes last quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group dropped the biggest position of all the hedgies tracked by Insider Monkey, valued at an estimated $30.3 million in stock. Robert Pohly’s fund, Samlyn Capital, also said goodbye to its stock, about $15.4 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as CBRE Group, Inc. (NYSE:CBRE) but similarly valued. These stocks are Affirm Holdings, Inc. (NASDAQ:AFRM), Verisk Analytics, Inc. (NASDAQ:VRSK), EPAM Systems Inc (NYSE:EPAM), Nasdaq, Inc. (NASDAQ:NDAQ), Cummins Inc. (NYSE:CMI), Barrick Gold Corporation (NYSE:GOLD), and Rocket Companies, Inc. (NYSE:RKT). This group of stocks’ market values match CBRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFRM | 39 | 1491413 | 14 |

| VRSK | 25 | 1638278 | -11 |

| EPAM | 42 | 945738 | 9 |

| NDAQ | 21 | 257290 | -2 |

| CMI | 30 | 830044 | -15 |

| GOLD | 41 | 917695 | -6 |

| RKT | 17 | 100749 | 4 |

| Average | 30.7 | 883030 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.7 hedge funds with bullish positions and the average amount invested in these stocks was $883 million. That figure was $3097 million in CBRE’s case. EPAM Systems Inc (NYSE:EPAM) is the most popular stock in this table. On the other hand Rocket Companies, Inc. (NYSE:RKT) is the least popular one with only 17 bullish hedge fund positions. CBRE Group, Inc. (NYSE:CBRE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CBRE is 75. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still managed to beat the market by another 3.6 percentage points. Hedge funds were somewhat right about betting on CBRE as the stock returned 4.1% since the end of September (through January 31st) and outperformed the top 5 hedge fund stocks but not the market. This is a rare phenomenon as top hedge fund stocks usually beat the market over the long-term.

Follow Cbre Group Inc. (NYSE:CBRE)

Follow Cbre Group Inc. (NYSE:CBRE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Largest Wind Energy Companies In The World

- Bruce Kovner’s Trading Strategy and Top 10 Picks

- 15 biggest companies that went bankrupt

Disclosure: None. This article was originally published at Insider Monkey.