Last year’s drought in the U.S. compelled many people to take short positions in the agriculture-related stocks. However, the market was taken by surprise when Warren Buffett announced a stake in Deere & Co (NYSE:DE), the farm-machinery manufacturer. Who was right: The market or Buffett?

Agriculture Outlook

The U.S. drought was expected to have an adverse impact on farm-machinery stocks in two ways:

1) Smaller crops meant less income at farmers’ disposal.

2) More importantly, less agricultural activity meant less wear and tear on farmers’ existing machines.

However, the bulls believed that the negative impact on farmers’ purchasing activity would not be as strong as originally anticipated, thanks to the effects of crop insurance, expiring tax provisions, and financing incentives from the State.

However, after such a fabulous 2012 for this industry, the naysayers have resumed chanting a bearish outlook for 2013. They believe it is difficult to see the peak stretching further given the ongoing drought, lower insurance guarantees, and potentially lower crop receipts. However, they do not understand that the extended and enhanced tax incentives may support U.S. farmers’ buying activity. Also, Brazil is beginning to truly benefit farm-machinery stocks. A record expected soybean crop and a weak currency, the Brazilian real, are supporting the farmers’ investment.

Moreover, the aversion of the U.S. fiscal cliff is another bullish catalyst for this industry. 50% bonus depreciation was extended for another year, and Section 179 benefits were extended and enhanced; this may support equipment purchase activity for the year, including a possible year-end pull-forward of demand. (To have an understanding of what this means, please go this link.)

The Best Stock in the Industry

The three farm-equipment stocks under my consideration are:

1) Deere & Co (NYSE:DE)

2) AGCO (NYSE:AGCO)

3) CNH (NYSE:CNH) Global

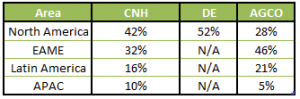

Buffet’s Deere seems to be the best stock to benefit from the potential surge in the demand for the farm-equipment. The following two tables will clarify the situation:

Among its peers, Deere has the largest proportion of total revenue coming from the North American region. Though CNH Global also has a sizeable exposure to North America, Deere gets 81% of its revenues by selling farm machinery (more than CNH’s 73%).

Also, Deere has heavily invested in Brazilian farms, which will help it to cash a strong growth in the country. (We do not know the exact proportion of Deere’s revenue from Brazil, because the company does not disclose it). AGCO, a pure-play on farm-machinery, is also expected to benefit from the strong expected crops in Brazil. However, it is not the best bet to benefit from the drought in the US because of its lower exposure to North America (as compared to Deere).

Valuations

Deere has outperformed the industry in Q1 2013 to date, with tractor sales up 61% and combine sales up 125%. This tells us that Warren Buffet made a right decision to invest in Deere.

The sell-side has revised Deere’s EPS estimate to $8.26 (from $8.00) for 2013. The agriculture segment is expected to grow by 4% (from 3%) this year. The price target of $100 represents a forward P/E multiple of 12 with a FY 2013 EPS estimate of $8.26.

Given a 10% upside from the current level, I recommend Deere as a buy.

The article Did Buffett Make a Mistake by Buying Deere? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.