Sands Capital, an investment management company, released its “Sands Capital Select Growth Fund” Q4 2024 investor letter. A copy of the same can be downloaded here. Select Growth primarily targets U.S. companies that are leading the way in crucial areas of positive structural transformation within the economy. The fund returned 8.8% (net) in the fourth quarter compared to 7.1% return for the benchmark, the Russell 1000 Growth Index. The fund returned 24.3% over the one year period compared to 33.4% return for the Index. You can check the fund’s top 5 holdings to know more about its best picks for 2024.

In its fourth quarter 2024 investor letter, Sands Capital Select Growth Fund emphasized stocks such as DexCom, Inc. (NASDAQ:DXCM). DexCom, Inc. (NASDAQ:DXCM) is a medical device company that develops and commercializes continuous glucose monitoring (CGM) systems. The one-month return of DexCom, Inc. (NASDAQ:DXCM) was -17.14%, and its shares lost 50.03% of their value over the last 52 weeks. On March 31, 2025, DexCom, Inc. (NASDAQ:DXCM) stock closed at $68.29 per share with a market capitalization of $26.777 billion.

Sands Capital Select Growth Fund stated the following regarding DexCom, Inc. (NASDAQ:DXCM) in its Q4 2024 investor letter:

“DexCom, Inc. (NASDAQ:DXCM) was a significant detractor from absolute and relative results in 2024, which we attribute to a combination of poor execution and fears of disruption by GLP-1 drugs.

The business’ second-quarter 2024 results were surprisingly weak, as a disruptive sales force reorganization and a rapid shift of patients to lower priced channels pressured volumes, revenues, and earnings. This poor execution worsened existential concerns about Dexcom’s addressable market, with GLP-1s viewed as potentially reducing the number of diabetics globally.

Third-quarter results demonstrated operational improvement. The chief commercial officer responsible for the disruptive reorganization was removed, Dexcom reported a record quarter for new patient additions, and volume growth exceeded 20 percent year-over-year. Additionally, Dexcom submitted its 15-day device to the U.S. Food and Drug Administration for approval six months earlier than expected…” (Click here to read the full text)

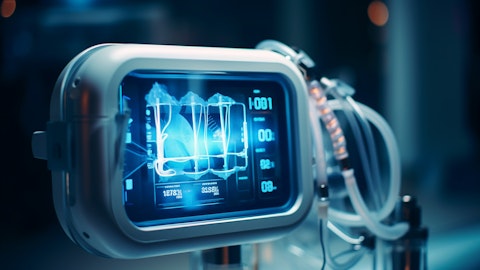

A doctor demonstrating how to use the medical device to a patient with diabetes.

DexCom, Inc. (NASDAQ:DXCM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 69 hedge fund portfolios held DexCom, Inc. (NASDAQ:DXCM) at the end of the fourth quarter compared to 55 in the third quarter. DexCom, Inc. (NASDAQ:DXCM) reported $1.11 billion in revenues in Q4 2024, compared to $1.03 billion in Q4 2023. While we acknowledge the potential of DexCom, Inc. (NASDAQ:DXCM) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

We covered DexCom, Inc. (NASDAQ:DXCM) in another article, where we shared the list of best diabetes stocks to buy according to billionaires. In addition, please check out our hedge fund investor letters Q4 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.