Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index returned about 7.6% during the last 12 months ending November 21, 2016. Most investors don’t notice that less than 49% of the stocks in the index outperformed the index. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 30 mid-cap stocks among the best performing hedge funds had an average return of 18% during the same period. Hedge funds had bad stock picks like everyone else. We are sure you have read about their worst picks, like Valeant, in the media over the past year. So, taking cues from hedge funds isn’t a foolproof strategy, but it seems to work on average. In this article, we will take a look at what hedge funds think about Devon Energy Corp (NYSE:DVN).

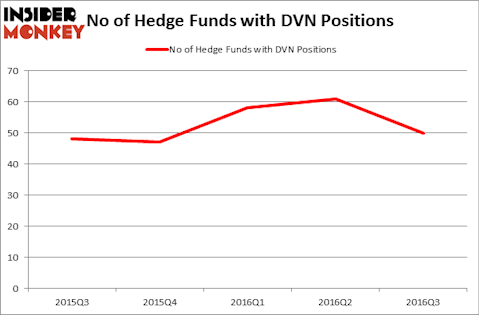

Is Devon Energy Corp (NYSE:DVN) a buy here? The best stock pickers are reducing their bets on the stock. The number of bullish hedge fund positions fell by 11 in recent months. In this way, there were 50 funds holding shares of the company at the end of September. At the end of this article we will also compare DVN to other stocks including Vornado Realty Trust (NYSE:VNO), M&T Bank Corporation (NYSE:MTB), and Deutsche Bank AG (USA) (NYSE:DB) to get a better sense of its popularity.

Follow Devon Energy Corp (NYSE:DVN)

Follow Devon Energy Corp (NYSE:DVN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively the most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Jeff Whyte / Shutterstock.com

How are hedge funds trading Devon Energy Corp (NYSE:DVN)?

Heading into the fourth quarter of 2016, a total of 50 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 8% from the end of June, after pushing above 60 hedge funds owning the stock. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the number one position in Devon Energy Corp (NYSE:DVN), worth close to $309.1 million. Sitting at the No. 2 spot is Jim Simons’ Renaissance Technologies, with a $169.6 million position. Other professional money managers that hold long positions include Ken Griffin’s Citadel Investment Group, Dmitry Balyasny’s Balyasny Asset Management, and D E Shaw.