However, by Monday, United had rolled back the fare increase after other carriers — particularly Southwest Airlines Co. (NYSE:LUV) — did not match it. After this failure, airlines have a pretty poor “batting average” this year in terms of price increases; of the eight attempted fare hikes this year, just two have stuck!

Clearly, airlines have no appetite for fare hikes right now due to sluggish demand. With oil prices starting to creep up again, this could crimp profitability during the second half of 2013.

A legacy of fare hikes

The airline industry’s renaissance over the last few years can be attributed in part to improved capacity discipline and pricing power. Even though oil prices rose steeply from 2009 to 2012, most of the major airlines were able to stay profitable by cutting unprofitable routes when necessary and raising fares on the remaining ones.

The fare increases occurred in waves; either all the major carriers would raise airfares, or none of them would. Since most travelers are very sensitive to price, no airline wants to have its prices consistently $10 higher than competitors.

In 2011, airlines attempted to raise airfares 22 times; of those attempts, nine were successful (or 10, according to some sources). Last year, airlines attempted 15 broad-based fare hikes, seven of which were successful. Thus, over those two years, nearly half of all fare hikes were successful. By contrast, airlines have not tried to raise fares as frequently this year, and have succeeded just twice.

Have we reached the breaking point?

There are a few good explanations for why airlines have had a harder time raising fares this year. First, having come into the year with higher fares (due to the past two years of fare hikes), there was less need for further fare increases. Second, while rising oil prices provided an impetus for frequent fare hikes in 2011 and (to a lesser extent) 2012, oil prices have remained relatively stable for most of 2013. Third, demand has been very uneven this year. While the airlines had a strong performance in June, most had to resort to discounting in order to fill seats in April and May.

In fact, airlines may have reached a breaking point with customers. Many travelers are simply not willing to pay any more for airline tickets. Peak season demand still seems fairly good, but airlines are having trouble filling seats at off-peak times without resorting to discounting. Customers’ reluctance to swallow additional airfare increases has finally put a lid on the endless cycle of fare hikes.

The catch

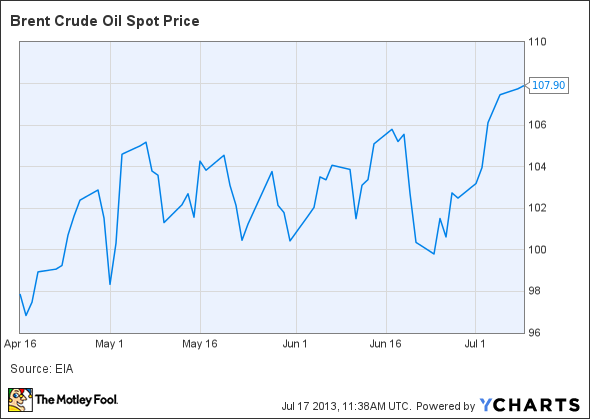

Failed attempts to raise airfares are a routine part of the airline business. What makes this failure so interesting is the fact that oil prices recently started to creep up again. After bouncing around near $100 for most of the spring, Brent crude oil prices have spiked to $108 in the last three weeks.

Brent Crude Oil Spot Price, data by YCharts