Since coming public in 2012, shares of Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG) are up more than 50%.

Brands

Del Frisco’s operates three distinct but similar restaurant concepts: Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG) Double Eagle Steakhouse, Del Frisco’s Grille, and Sullivan’s Steakhouse. To better understand Del Frisco’s as a whole, let’s take a closer look at each of Del Frisco’s three concepts:

Del Frisco’s Double Eagle Steakhouse

One of the premier fine dining steakhouses in the U.S. featuring prime beef and award winning wine selections, Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG)’s Double Eagle Steakhouse has 10 locations across eight states. Average check is $100. First quarter revenue increased by $4 million or 14.1% to $32.3 million. Same-store-sales increased by 1.9% (13th consecutive quarterly increase) .

Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG)’s Double Eagle Steakhouse is Del Frisco’s highest-end offering. So far, this brand appears to be doing exceptionally well.

Del Frisco’s Grille

Classic American grill featuring the same steaks as Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG)’s Double Eagle Steakhouse but also a variety of less expensive entrees. Del Frisco’s Grille currently has six locations and average check is $53. Three of the six Del Frisco’s Grille’s opened in 2012. First quarter revenue increased 90% to $7.6 million.

The Del Frisco’s Grille concept is the fastest growing part of Del Frisco’s. However, it also makes up the smallest part of Del Frisco’s total revenues.

Sullivan’s Steakhouse

Vibrant energetic steakhouse featuring fine steaks and a broad offering of seafood. Sullivan’s has 18 locations across 15 states. Average check at Sullivan’s is $59. First quarter revenue decreased $0.7 million to $19.9 million. These results were due in part to a 4% decrease in same store sales.

Certainly, Sullivan’s is the weakest part of Del Frisco’s. On the Q1 conference call, a question was asked about the weakness at Sullivan’s. CEO Mark Mednansky responded:

So, during the – especially the beginning of the quarter, we think that the middleclass and upper-middleclass guests were as you know affected by the tax increases…They are still coming in. They still want to dine but perhaps they weren’t ordering extra appetizer or cocktail or more pricy bottle of wine. With that being said, we have always positioned Sullivan’s as more of value play within a white table cloth Steak House segment. But sometimes we didn’t do a very good job of marketing that. So, that’s something that’s on Jeff Carcara’s bucket list right now. He is getting the appreciation and getting the recognition for the true value that the Sullivan’s brand does display. So, there is a few initiatives that we started at the very end of the quarter that will proceed in the second quarter that we’re excited about.

Whether Del Frisco’s will be able to turn around the problems at Sullivan’s remains to be seen. It should be noted that despite being Del Frisco’s largest segment in terms of units (19), Sullivan’s as a percentage of total revenue is actually smaller than Del Frisco’s Double Eagle Steakhouse. That being said, Sullivan’s still accounts for a high percentage of Del Frisco’s total revenues and therefore must be a focus for investors.

Complementary Brands

Del Frisco’s is different from its competitors in that its brands are quite similar and therefore complementary. In contrast, larger competitors such as Darden Restaurants, Inc. (NYSE:DRI), Landry’s, and Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH), owner of Ruth’s Chris Steakhouse, have multiple brands, but the brands are unrelated to each other. For example, there is little awareness that Longhorn Steakhouse and The Capital Grille are owned by the same company, Darden Restaurants, Inc. (NYSE:DRI). When a customer thinks of going to Longhorn, there is no thought about the association to one of the world’s leading steakhouses, The Capital Grille. Likewise, there is little brand association between Ruth’s Chris Steakhouse and Mitchell’s Fish Market, though they are both owned by Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH). For Del Frisco’s, this is not the case. In particular, there is a strong brand connection between Del Frisco’s Double Eagle Steakhouse and Del Frisco’s Grille because they both use the name Del Frisco’s. Another way in which Del Frisco’s brands complement each other is when looking at various locations. A particular location may not be well suited for a Del Frisco’s Double Eagle Steakhouse but it may be a good spot for a Del Frisco’s Grille. For Darden, if a location is not good for an Olive Garden then it also unlikely to be a good fit for a Red Lobster or Longhorn as the price point is similar across all three brands.

Thoughts on Darden

Darden recently reported fiscal fourth quarter results:

1). $1.01 EPS vs $1.15 EPS a year ago

2). Profit missed forecasts by 3 cents

3). 2.2% same store sales growth

In my opinion, Darden is a solid investment. Currently, Darden is trading at 15 times forward earnings and has a dividend yield of 4.4%. While the company has stumbled somewhat in terms of operational performance, the company has strong brands which I believe are likely to continue generating solid profits for shareholders. That being said, I see no near-term catalyst to send shares surging. Instead, I see Darden as a good long-term investment.

Ruth’s Hospitality

Like Darden, I view Ruth’s as a solid, investable company. Over the past few years, as shares have rallied from the low single-digits to the mid double-digits, Ruth’s has made improvements. In particular, it has reduced the amount of debt outstanding. For a small company such as Ruth’s, this is important as a high debt load can put the company in a risky position during economic downturns such as 2008. Ruth’s does trade at a forward PE ratio close to 20 and thus is not a cheap stock. If shares were to pull back in the coming months, I would consider investing. However, current valuations are a bit rich for me.

More on Del Frisco’s

Growth

Del Frisco’s plans to open 3-5 new restaurants every year. Currently, Del Frisco’s operates a total of 34 restaurants, which is considerably smaller than some of Del Frisco’s leading competitors. The Capital Grille operates 48 restaurants, Mortons operates 70 restaurants, and Ruth’s Chirs Steakhouse operates 159 restaurants (including franchised units). Clearly, there is room for Del Frisco’s to grow without saturation.

Balance Sheet

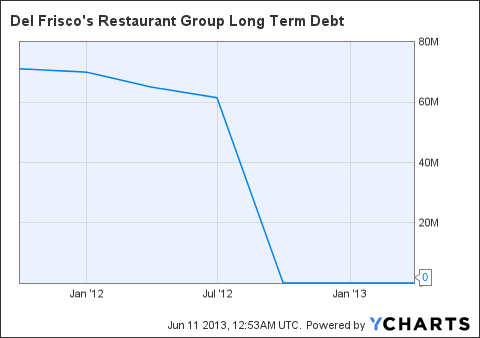

Currently, Del Frisco’s has $9 million in cash and no debt. Before coming public in July 2012, as shown by the chart below, Del Frisco’s had some debt. However, the company used a portion of IPO proceeds to pay it off. Del Frisco’s lack of a debt load is advantageous for a few reasons. Firstly, Del Frisco’s does not have any interest cost, which means that earnings are not reduced. Furthermore, no debt means Del Frisco’s is well positioned to handle any significant downtown in either the economy or capital markets. Finally, no debt means Del Frisco’s could issue debt down the road if desired for various purposes such as a share buyback or a takeover of another company.

Valuation

Del Frisco’s trades at nearly 21 times forward earnings, the highest in the company’s history. Of course, it should be noted that Del Frisco’s has only been public for close to a year so it is difficult to judge current valuations relative to historic norms. That being said, we can compare Del Frisco’s valuation to other similar companies such as Ruth’s Hospitality, Bravo Brio Restaurant Group, Inc. (NASDAQ:BBRG), and Darden.

Del Frisco’s is the most expensive of the group. However, it should be noted that Del Frisco’s is smaller than the aforementioned companies. Also, Del Frisco’s does not have any debt. That being said, it is difficult to argue that Del Frisco’s is cheap.

Conclusion

In my opinion, Del Frisco’s has a bright future. In particular, the company’s Del Frisco’s Double Eagle Steakhouse and Del Frisco’s Grille are poised to grow rapidly. In my opinion, one major advantage that Del Frisco’s has is its cross brand recognition. Over time, I would expect the company to continue to shift towards the Del Frisco’s Grille concept as the target market is larger. The brand association between Del Frisco’s Double Eagle Steakhouse and Del Frisco’s Grille should be an advantage for the company. Judging by current valuations, other investors seem to agree with me that the future is bright for Del Frisco’s. While I don’t think it is a bad investment at current levels, I believe that investors would be better served waiting for a pullback before buying.

Sammy Pollack has no position in any stocks mentioned. The Motley Fool owns shares of Darden Restaurants (NYSE:DRI).

The article Del Frisco’s Restaurant Group: A Solid Small-Cap Stock originally appeared on Fool.com and is written by Sammy Pollack.

Sammy is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.