Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 57%. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 41.3% in 2019 and outperformed the broader market benchmark by 10.1 percentage points. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

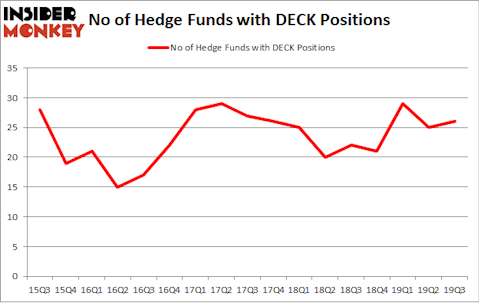

Deckers Outdoor Corp (NASDAQ:DECK) has seen an increase in hedge fund interest in recent months. DECK was in 26 hedge funds’ portfolios at the end of the third quarter of 2019. There were 25 hedge funds in our database with DECK holdings at the end of the previous quarter. Our calculations also showed that DECK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

To the average investor there are several formulas stock market investors have at their disposal to evaluate publicly traded companies. A couple of the less known formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the top money managers can outclass their index-focused peers by a superb amount (see the details here).

Cliff Asness of AQR Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to take a look at the new hedge fund action encompassing Deckers Outdoor Corp (NASDAQ:DECK).

How are hedge funds trading Deckers Outdoor Corp (NASDAQ:DECK)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the second quarter of 2019. On the other hand, there were a total of 22 hedge funds with a bullish position in DECK a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the largest position in Deckers Outdoor Corp (NASDAQ:DECK). AQR Capital Management has a $181.8 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $56.1 million position; 0.1% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish include Pasco Alfaro / Richard Tumure’s Miura Global Management, Steve Cohen’s Point72 Asset Management and Paul Marshall and Ian Wace’s Marshall Wace. In terms of the portfolio weights assigned to each position Miura Global Management allocated the biggest weight to Deckers Outdoor Corp (NASDAQ:DECK), around 5.84% of its 13F portfolio. North Fourth Asset Management is also relatively very bullish on the stock, dishing out 1.79 percent of its 13F equity portfolio to DECK.

Consequently, key money managers have jumped into Deckers Outdoor Corp (NASDAQ:DECK) headfirst. Interval Partners, managed by Gregg Moskowitz, assembled the most valuable position in Deckers Outdoor Corp (NASDAQ:DECK). Interval Partners had $10.3 million invested in the company at the end of the quarter. Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital also made a $8.7 million investment in the stock during the quarter. The following funds were also among the new DECK investors: Matthew Hulsizer’s PEAK6 Capital Management, Anthony Joseph Vaccarino’s North Fourth Asset Management, and George McCabe’s Portolan Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Deckers Outdoor Corp (NASDAQ:DECK). We will take a look at Wyndham Destinations, Inc. (NYSE:WYND), Perspecta Inc. (NYSE:PRSP), Service Properties Trust (NASDAQ:SVC), and Tempur Sealy International Inc. (NYSE:TPX). This group of stocks’ market values are closest to DECK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WYND | 21 | 521654 | -1 |

| PRSP | 40 | 719169 | 0 |

| SVC | 13 | 48463 | 0 |

| TPX | 29 | 1355351 | -4 |

| Average | 25.75 | 661159 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $661 million. That figure was $415 million in DECK’s case. Perspecta Inc. (NYSE:PRSP) is the most popular stock in this table. On the other hand Service Properties Trust (NASDAQ:SVC) is the least popular one with only 13 bullish hedge fund positions. Deckers Outdoor Corp (NASDAQ:DECK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on DECK, though not to the same extent, as the stock returned 32% during 2019 and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.