David Einhorn’s Greenlight Capital is one of the most prominent and followed value-oriented hedge funds on Wall Street. Between 1996 and 2013, it managed to return 19.5% per year, on average. However, 2016 has not been a great year for the firm, which only gained 3.8% in the first nine months of the year according to its third-quarter letter to investors, versus the S&P 500’s 7.8% surge.

In this article we’ll take a look into some of the most notable moves disclosed by Greenlight in its third-quarter 13F filing. As per the document, the firm’s equity portfolio was valued at $5.23 billion on September 30 and had a slight focus on consumer discretionary (25% of its portfolio’s value), information technology (18%), and industrials (16%) stocks.

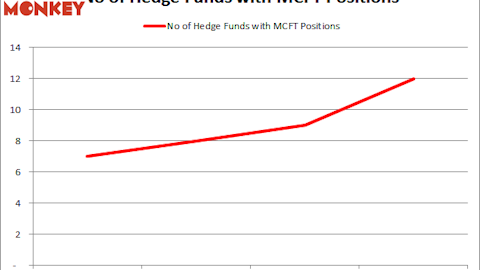

At Insider Monkey, we track around 750 hedge funds and institutional investors. Through extensive backtests, we have determined that imitating some of the stocks that these investors are collectively bullish on can help retail investors generate double digits of alpha per year. The key is to focus on the small-cap picks of these funds, which are usually less followed by the broader market and allow for larger price inefficiencies (see more details about our small-cap strategy).

Twenty-First Century Fox Inc (NASDAQ:FOXA)

Let’s start with Twenty-First Century Fox Inc (NASDAQ:FOXA), which was one of Greenlight’s top-15 positions on June 30, being valued at almost $129 million at the end of the second quarter. However, between July and September, the fund sold all 4.76 million shares it held on June 30, possibly seeking to cut its losses, as the stock tumbled by 10.3%. Another fund that jumped ship was Thomas Steyer’s Farallon Capital Management, which disposed of more than 5 million shares over the third quarter.

Both Einhorn and Steyer must be regretting their decision to leave Twenty-First Century Fox Inc (NASDAQ:FOXA), as the shares rebounded by more than 15% since the fourth quarter started, helped by AT&T Inc. (NYSE:T)’s potential acquisition of Time Warner Inc (NYSE:TWX), and by a top- and bottom-line beat with its fiscal first quarter results. EPS of $0.51 beat the Street’s consensus by $0.07, while revenue of $6.51 billion came in $20 million ahead of expectations.

Follow Twenty-First Century Fox Inc. (NASDAQ:TFCF,TFCFA)

Follow Twenty-First Century Fox Inc. (NASDAQ:TFCF,TFCFA)

Receive real-time insider trading and news alerts

Take-Two Interactive Software, Inc. (NASDAQ:TTWO)

Next up is Take-Two Interactive Software, Inc. (NASDAQ:TTWO), in which Greenlight cut its position in half over the third quarter, to 1.37 million shares, valued at $62.12 million at the end of the period. The move should not necessarily be interpreted as a bearish signal though; with the stock up by 39% year-to-date, and having gained 23.1% in the third quarter, the sale was more likely a profit-taking and/or portfolio rebalancing move. Also taking profits while remaining a big investor in Take-Two Interactive Software, Inc. (NASDAQ:TTWO) was Jim Simons’ Renaissance Technologies, which held 2 million shares on September 30, after disposing of 20% of its stake in the third quarter.

Take-Two shares have continued to surge in the fourth quarter, gaining another 7%. However, in a recent research note, Loop Capital warned that Take-Two was among the tech companies that would be most hit by a Trump presidency and its proposed protectionism measures.

Love Take-Two’s games? Why not take a look at our list of the 11 Best PC Games of 2015.

Follow Take Two Interactive Software Inc (NASDAQ:TTWO)

Follow Take Two Interactive Software Inc (NASDAQ:TTWO)

Receive real-time insider trading and news alerts

On the next page we’ll run through three more stocks favored by Einhorn and his team.