There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY).

Is Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) a bargain? Investors who are in the know are betting on the stock. The number of bullish hedge fund bets inched up by 1 recently. At the end of this article we will also compare PLAY to other stocks including Qunar Cayman Islands Ltd (NASDAQ:QUNR), NOW Inc (NYSE:DNOW), and The New York Times Company (NYSE:NYT) to get a better sense of its popularity.

Follow Dave & Buster's Entertainment Inc. (NASDAQ:PLAY)

Follow Dave & Buster's Entertainment Inc. (NASDAQ:PLAY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: sainaniritu / 123RF Stock Photo

With all of this in mind, we’re going to view the fresh action encompassing Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY).

What have hedge funds been doing with Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY)?

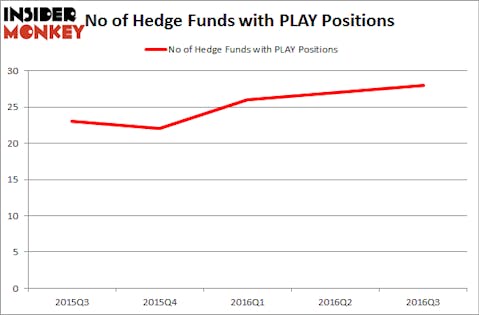

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 4% from one quarter earlier. Hedge fund ownership of the stock has now trended up for three-straight quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Newbrook Capital Advisors, managed by Robert Boucai, holds the number one position in Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY). Newbrook Capital Advisors has a $77.5 million position in the stock, comprising 6.9% of its 13F portfolio. Coming in second is Ken Griffin of Citadel Investment Group, with a $64.1 million position. Remaining professional money managers that are bullish encompass Steve Cohen’s Point72 Asset Management, Joel Ramin’s 12 West Capital Management and Gabriel Plotkin’s Melvin Capital Management.