Dan Loeb founded Third Point in 1995. Using an activist value-oriented investing style, the New York-based fund has enjoyed tremendous success. Loeb’s flagship fund returned 41.7% in 2010. Last year was less than stellar for Third Point, but it still managed to roughly break even, which is pretty good considering that the average hedge fund lost around 4% that year. Loeb certainly didn’t have any love lost with his investors. In fact, the size of his portfolio actually increased during the fourth quarter. According to its 13F filings with the SEC on February 14, Third Point went from a portfolio of 35 positions valued at $2.11 billion at the end of September to finish December with 40 holdings, collectively valued at just under $2.5 billion.

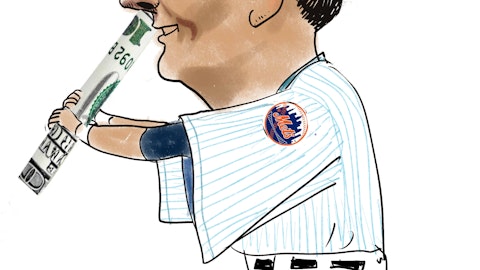

One of the ways Dan Loeb drives the success of his Third Point is by taking activist positions in his fund’s investments, like the massive $903.29 million stake (56 million shares) he had in Yahoo (YHOO) at the end of the fourth quarter. Loeb has been working with Yahoo for months, actively pushing for a change in the company’s management (read about it here). In a letter to Yahoo’s board on that subject, Dan Loeb said that he thinks Yahoo is “grossly undervalued” at $13.61 a share and that he places the company’s target price closer to $19 a share. When the markets closed on February 17, Yahoo was trading at $15.01 a share with a mean one-year target estimate of $17.46. Right now, Yahoo is priced at 16.14 times its forward earnings. Analysts estimate the company’s earnings will grow by 11.46% per annum over the next five years, versus expectations of 16.40% for its industry.

Yahoo is positioned much better than some of its rivals. Take AOL Inc (AOL) for instance. The company closed trading at $18.73 a share with a mean one-year target estimate of $19.20 a share and doesn’t pay a dividend. On top of that, AOL is priced much higher relative to its future earnings, with a forward P/E of 28.38.

Third Point’s second largest position at the end of the fourth quarter was a 7.80 million-share position in Sara Lee (SLE) worth $147.58 million. Loeb had increased his position in Sara Lee considerably during the fourth quarter, adding 1 million shares. The value of his position in the company was just $111.18 million at the end of the third quarter.

Sara Lee sold its North American foodservice and hot beverage business on January 3, 2012 to JM Smucker (SJM). Smucker had purchased Rowland Coffee Roasters in May 2011. The acquisition of the Sara Lee foodservice and hot beverage business is a complement to that. It also allowed Sara Lee to start concentrating its focusing on the company’s core business.

When the markets closed on February 17, Sara Lee was trading at $20.29 a share, on a mean one-year target estimate of just $20.50. The company pays a dividend of 46 cents, or 2.30% yield, and is priced at 19.32 times its forward earnings. Sara Lee is okay, but we don’t see it as anything better than a hold position right now. Selling its foodservice and hot beverage business may be the turning point this company needs to go from a good company to a great one, but it is just too soon to tell.

Even then, we would recommend it as a sell for anyone that had bought in low – better to put the money in an investment that has better upside, like Sara Lee rival Kraft Foods (KFT). Kraft was trading at $38.01 a share when the markets closed on February 17 and it has a mean one-year target estimate of $41.12. The company also pays a $1.16 dividend (3.10% yield). Kraft is even priced lower relative to its future earnings than Sara Lee, with a forward P/E of 15.08. There is another reason to be hopeful about Kraft – It is in the process of dividing its business into two. One would focus on its global brands, like Oreo and Cadbury, while the other would focus on its North American grocery business, which includes brands like Oscar Mayer and Jell-O.

Dan Loeb was also bullish about El Paso (EP) at the end of December. His Third Point had a 5.55 million-share stake in the company worth about $147.46 million, down from the 7 million shares worth $122.36 million Loeb had had in the company at the end of the third quarter. Kinder Morgan (KMI) announced in October that it would acquire all of El Paso’s outstanding shares for a total of $38 billion in a combination of cash, stocks and warrants. The transaction is expected to be completed by the end of the second quarter 2012.

El Paso was trading at $27.16 when the markets closed on February 17, which is past its mean one-year target estimate of $27.09, but $2 less per share than what Kinder Morgan is offering. The company does pay a dividend, but it is just 4 cents a share (0.10% yield), and it is priced high at 22.63 times its forward earnings. There might be room for a merger arbitrage play, but we would rather put our money with El Paso competitor Williams Companies (WMB). Williams was trading at $29.11 when the markets closed on February 17 and has a mean one-year target estimate of $31.56 . The company also pays a $1.04 dividend (3.60% yield) and is bargain compared to El Paso – Williams has a forward P/E of just 19.28.