It appears some investors are gearing up for a nice rally in the housing market. Earlier this week, a number of major companies with exposure to housing spiked on news that “housing is firing on all cylinders.” This being supported by strong new home sales numbers from the Commerce Department, which showed January new home sales had jumped 15.6% year over year for the month.

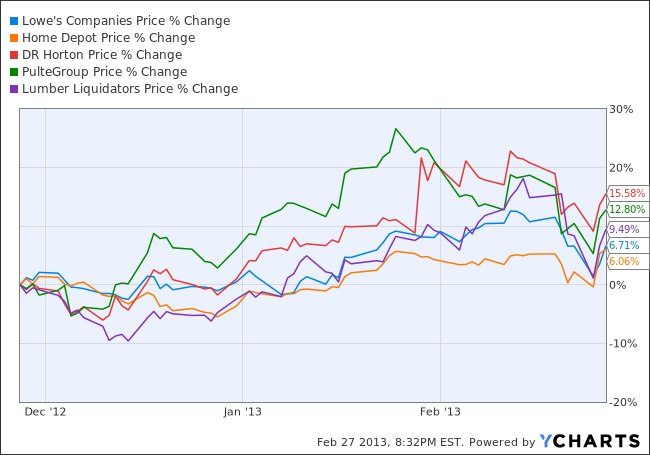

A few of the key housing and home improvement companies seeing their shares jump include D.R. Horton, Inc. (NYSE:DHI), PulteGroup, Inc. (NYSE:PHM), Lumber Liquidators Holdings Inc (NYSE:LL), The Home Depot, Inc. (NYSE:HD) and Lowe’s Companies (NYSE:LOW):

Low mortgage rates and lower housing inventory have helped spur this

rise

, and in turn has lifted consumer confidence levels. Helping further push up notable home improvement retailer Home Depot was its recent quarterly results, where the company posted fourth quarter EPS results that came in at $0.67, up 34% from the same quarter last year. This earnings beat came on the back of 14% sales increase and 7% comp sales increase in the U.S.

Home Depot now expects to earn $3.37 in earnings per share in 2013, a 12% increase from 2012. This, driven by robust numbers across the board: Expected 2% increase in sales, comp sales increase of 3% and 65 basis points gross margin growth for 2013.

On the other hand, Lowe’s (NYSE:LOW) recently posted EPS of $0.26, which was flat from the same quarter last year, but did beat analysts’ estimates of $0.23. The slight improvement comes on the back of the damage caused by Superstorm Sandy, which I noted could be the case shortly after the storm hit (read more here.) Management now plans to concentrate on store refurbishing, merchandising and operational efficiencies.

Other plays on the housing and home improvement market include D.R. Horton, Inc. (NYSE:DHI), PulteGroup, Inc. (NYSE:PHM), and Lumber Liquidators (NYSE:LL). D.R. Horton posted solid EPS of $0.30 last quarter, up 180% from the same quarter last year. Its home building revenues were up 21%, and the company has impressive geographic diversity. D.R. Horton performed relatively well throughout the housing downturn by generating cash flow by selling off land inventory. The company now has a strong balance sheet, with cash of $1 billion.

PulteGroup also had strong recent quarterly results that showed EPS of $0.27 per share, topping earnings of $0.11 in the prior-year quarter. The home builder has been performing well, with gross margin expansion on the back of a recovering home building market. Home building revenue for Pulte was up 12% last quarter year over year. Pulte is also the largest builder of retirement communities, which is expected to be one of the fastest growing segments: The number of Americans in the age group of 55-75 will reach roughly 80 million by the end of 2020.

Lumber Liquidators, a major provider of wood flooring, expects fiscal year 2013 net sales to come in the range of $885 to $920 million after lowered guidance.

EPS

is now expected to be $1.90 to $2.15, and according to consensus estimates are on the low end of the range at $888 million in sales and

EPS

of $2.03 for 2013.

Lumber Liquidators also appears to be rather expensive, with a 15% annual expected EPS growth rate for the next five years, but its 35x P/E puts its PEG ratio at 2.3 (anything above 2 is expensive.) Reaffirming the expensiveness of the stock is the fact it trades above the industry average P/E of 22x. As well, Lumber Liquidators’ 5-year average premium to the S&P 500 P/E is 150%, but the stock trades near 230% today.

Industry tailwinds

The outlook for the home improvement industry will in part be driven by a rebounding housing market. Housing starts were down 38% in 2009, but rebounded in 2010 by 5% then 5% in 2011. S&P expects an additional 26.5% rise in 2012, and 42% in 2013. Beyond this, the remodeling of aging homes should continue despite the overall status of the housing market, where increased foreclosures should promote greater renovation projects (

read more about the housing outlook.)

So where’s the best value to be had?