I have selected the laser equipment manufacturers in the medical appliances industry, which are currently in their high growth phase and are likely to give high return in the coming few years.

The medical equipment industry’s demand is driven by population demographics and advanced medical technology. The economic advantage of individual companies lies in the capability to develop improved better-quality products. Large companies can obtain the benefits of economies of scale due to large scale manufacturing and research & development. Small companies can compete effectively by focusing on a particular niche market, or by means of technical innovation.

The U.S. industry is highly concentrated, with the 50 largest companies making up to 60 percent of revenue. Syneron Medical Ltd. (NASDAQ:ELOS) is the current market leader in the industry, followed by Cynosure, Inc. (NASDAQ:CYNO). The recent acquisition of Palomar Medical Technologies Inc (NASDAQ:PMTI) has made Cynosure closer to Syneron in terms of total revenues from sale of medical equipment. Solta Medical Inc (NASDAQ:SLTM), Cutera and ZEL TIQ are the smaller players in the medical appliances industry.

Will Cynosure’s acquisition of Palomar bring synergies?

Cynosure, Inc. (NASDAQ:CYNO), a leading company in laser and light based treatments for minimally invasive and non-invasive aesthetic applications, recently declared the acquisition of its overseas competitor, Palomar Medical Technologies Inc (NASDAQ:PMTI). This report analyzes the acquisition by Cynosure, Inc. (NASDAQ:CYNO) and the combined company has also been compared with the market leader, Syneron Medical Ltd. (NASDAQ:ELOS).

Both companies, Cynosure and Palomar, have joined hands and are expected to bring together world class research and development by designing the world’s highest quality aesthetic laser and light based equipment. The ownership agreement gives 77% share to Cynosure and 23% to Palomar. This purchase is expected to supplement Cynosure, Inc. (NASDAQ:CYNO)’s product range and customer base, with added product and service revenues, stronger global distribution network, and it provides cross-selling opportunities. The grouping of the two companies is intended to be a long term growth strategy.

The two companies are expected to perform better as a single company and will be able to charge higher rates for their products as the competition decreases. The laser equipment industry will continue to expand, mostly in the areas of skin rejuvenation, skin tightening and body shaping. As light-based treatments increase across the world, Cynosure, Inc. (NASDAQ:CYNO) will experience an increasing demand.

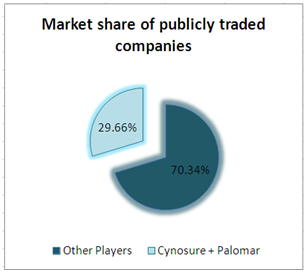

Source: Company Presentation

Together Cynosure and Palomar Medical Technologies Inc (NASDAQ:PMTI)’s revenues make up almost 30% of the market. This is close to the 33% market share of Syneron, the market leader. This implies that Cynosure will be able to capture 30% of the increase in world-wide demand for light based devices, assuming all factors remain constant.

Syneron Medical Ltd. (NASDAQ:ELOS) is trying to fight back to maintain and increase its market share. The company recently announced its innovative body shaping products, including UltraShape V3 system. This exclusive fat selective technology gives physicians a complete body sculpting solution that allows targeted, non-invasive fat destruction.

The acquisition is expected to benefit Cynosure, Inc. (NASDAQ:CYNO) in Fiscal Year (FY) 2014, with expected synergies from $8-10 million. The synergies will mainly take the form of cost savings in administration and management expenses, marketing and international distribution.

Cynosure will now be able to benefit from sales in the Australian market as well. The company itself did not have a distribution network in Australia whereas Palomar is operating in this country. This will save international distribution costs for Cynosure.