As of January 7, 2018, there were about 1,384 cryptocurrencies in the market and there’s a growing list of pre-ICO cryptocurrencies preparing to make their debut in the market. The impressive gains that cryptocurrencies such as Bitcoin, Ethereum, and Ripple delivered in 2017 is causing a surge in interest from traditional investors who had hitherto disdained cryptocurrencies.

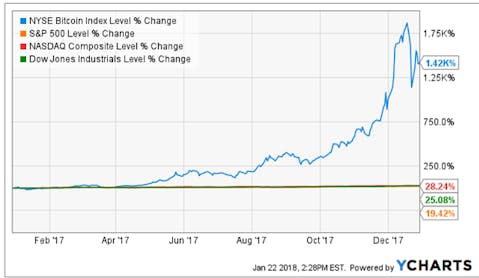

Bitcoin for instance, delivered 1,420% gains in 2017 whereas the S&P 500 only delivered 19.42%, the Dow Jones delivered 25.08%, and the NASDAQ delivered 28.24% in the same period (see chart below).

However, despite the latent potential and obvious possibilities in cryptocurrencies, traditional Wall Street traders and investors might still be somewhat skeptical about getting involved in the market. This piece looks at how cryptocurrency traders and investors could leverage one of the most disruptive technologies in the market for increased mainstream adoption.

Here’s how a company wants to build a Wall Street for cryptocurrency

Wall Street has grown from the ancient order of auction-to-computer trading to highly specialized algorithm trading systems. Now, most of the trading activities that happen on Wall Street are executed by algorithm trading systems. Computer algorithms make trading decisions based on predefined instructions encoded in trading strategies. Some institutional investors also up the ante with specialized high-frequency trading algorithms that uses powerful computers to process a large volume of orders at very high speeds.

Signals, a blockchain startup is trying to help cryptocurrency traders increase the odds of their trading success by providing a platform where traders can create and find computer algorithm backed with the distilled wisdom of machine learning to place and execute trading actions. Signals strongly believes that humans can leverage machine intelligence for profit in cryptocurrency trading and investments.

Here’s how computer algorithms and machine learning help crypto traders

One of the key selling points of Signals’ solution is that it allows anybody with an understanding of the cryptocurrency and financial markets to build algorithm-controlled trading models even without a background in programming or coding. You can select your preferred traditional technical indicators such as Bollinger bands and 50-day moving averages and match them with sentiment analysis and deep learning elements to create a new trading model for cryptocurrencies.

Before you deploy your new trading model to the market, you can push the model to an exchange in order to backtest its efficacy against historical trading data. You can then tweak the elements of your strategy in order to be sure that your trading model is optimized to deliver the best odds of success. The best part is that you get to access an incredible amount of computational power connected to a decentralized supercomputer or use the proprietary Signals application to domicile the model on your own computer.

After you have perfected your trading model, you can deploy the strategy to get involved in the market with real-time data. You can choose to receive notifications for trading opportunities once predetermined conditions are met. You can also automate your trading system so that you don’t have to rush up to your computer every time you receive a trading notification. You can take your trading experience a notch higher by making your data science algorithm adaptive such that it is constantly tweaking its settings as new trends surface in the market.

Instead of being the only person that benefits from the quality of your trading strategy you can place your trading model in the market where others copy trade your strategy while paying in exchange for the privilege. You can also learn from other market analysts by looking through the Strategy marketplace to find new trading ideas and strategies.

How soon can you start leveraging algo-trading on cryptocurrencies?

Signals has the potential to be a game-changer for cryptocurrency traders and investors but it still a couple of months away from entering the market. Between Q2 and Q4 2017, Signals had implemented the private alpha for its Strategy Builder Framework, it has implemented its Strategy Builder UI Design, and it held the presale for its Signals Token (SGN). Signals will leverage SGN, an Ethereum blockchain based ERC 20 toke to provide exclusive access to some premium features on its network. For instance, Signals will charge a fee on every purchase such as data streams, strategies, and indicators in its marketplace – such fees will be paid for with the SGN Token.

During Q1 2018, the firm will set up it the alpha phase of its Strategy Marketplace and raise money through the SGN Token sale. By Q2 2018, the private alpha for Data Marketplace and Indicators Market place will be launched. Going forward in Q3 through Q4 2018, the company will start Machine Learning strategy optimization, integration of decentralized supercomputers, and the public alpha of its Data marketplace among other things.

Final words…

It is important to pay attention to the distinction between Signals and its pseudo-competitors in the same industry. For one, Signals aims to provide traders with a platform where they can build trading strategies for others to use. Its competitors such as Santiment and Cindicator provide traders with trading signals in exchange for a subscription fee. Signals is however not trying to build a proprietary trading algorithm that where you can subscribe for trading signals or direction. Rather, Signals is trying to be a toolbox that developers, data scientists, and financial analysts can collaborate to build algorithm-trading strategies.