Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

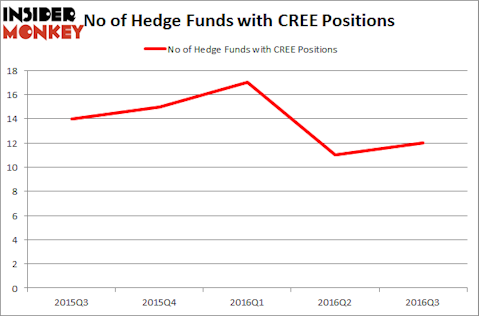

Cree, Inc. (NASDAQ:CREE) was in 12 hedge funds’ portfolios at the end of the third quarter of 2016. CREE has experienced an increase in support from the world’s most successful money managers recently. There were 11 hedge funds in our database with CREE holdings at the end of the previous quarter. At the end of this article we will also compare CREE to other stocks including F.N.B. Corp (NYSE:FNB), Zynga Inc (NASDAQ:ZNGA), and Buffalo Wild Wings (NASDAQ:BWLD) to get a better sense of its popularity.

Follow Wolfspeed Inc. (NYSE:WOLF)

Follow Wolfspeed Inc. (NYSE:WOLF)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

solarseven/Shutterstock.com

What have hedge funds been doing with Cree, Inc. (NASDAQ:CREE)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a rise of 9% from the second quarter of 2016. On the other hand, there were a total of 15 hedge funds with a bullish position in CREE at the beginning of this year. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, led by Chuck Royce, holds the number one position in Cree, Inc. (NASDAQ:CREE). Royce & Associates has a $11.9 million position in the stock. On Royce & Associates’s heels is Citadel Investment Group, led by Ken Griffin, which holds a $8.1 million position. Other hedge funds and institutional investors with similar optimism contain Neal Shah’s Valtura Capital Partners, and Matthew Hulsizer’s PEAK6 Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, key hedge funds were breaking ground themselves. Valtura Capital Partners, led by Neal Shah, created the largest position in Cree, Inc. (NASDAQ:CREE). Valtura Capital Partners had $5.9 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $5.5 million position during the quarter. The other funds with new positions in the stock are Millennium Management, one of the 10 largest hedge funds in the world, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and David Harding’s Winton Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Cree, Inc. (NASDAQ:CREE) but similarly valued. These stocks are F.N.B. Corp (NYSE:FNB), Zynga Inc (NASDAQ:ZNGA), Buffalo Wild Wings (NASDAQ:BWLD), and Janus Capital Group Inc (NYSE:JNS). All of these stocks’ market caps are similar to CREE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNB | 14 | 169080 | 2 |

| ZNGA | 28 | 476683 | 8 |

| BWLD | 29 | 369089 | 4 |

| JNS | 20 | 306404 | 5 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $330 million. That figure was $45 million in CREE’s case. Buffalo Wild Wings (NASDAQ:BWLD) is the most popular stock in this table. On the other hand F.N.B. Corp (NYSE:FNB) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Cree, Inc. (NASDAQ:CREE) is even less popular than FNB. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None