On Mar. 12, Costco Wholesale Corporation (NASDAQ:COST) released second-quarter earnings and again illustrated its strength in growing both revenue and earnings through a disciplined strategy that has built intense customer loyalty. In the second-quarter, Costco was able to grow same store sales (excluding gasoline and inflation) at a rate of 5%. This is unprecedented in an industry that has recently been characterized by heightened competition and difficulty surrounding same store sales growth.

For comparison, Target Corporation (NYSE:TGT) reported only a .4% increase in fourth-quarter same store sales, while the nations largest retailer, Wal-Mart Stores, Inc. (NYSE:WMT), reported only a 1.2% increase in store for store sales in fourth-quarter 2012. This discrepancy between Costco Wholesale Corporation (NASDAQ:COST) and its peer group illustrates the company’s ability to maintain a consistent pricing strategy (both internally and externally) that leads it quarter after quarter to increased revenue and shareholder value. The company’s second-quarter results are as follows:

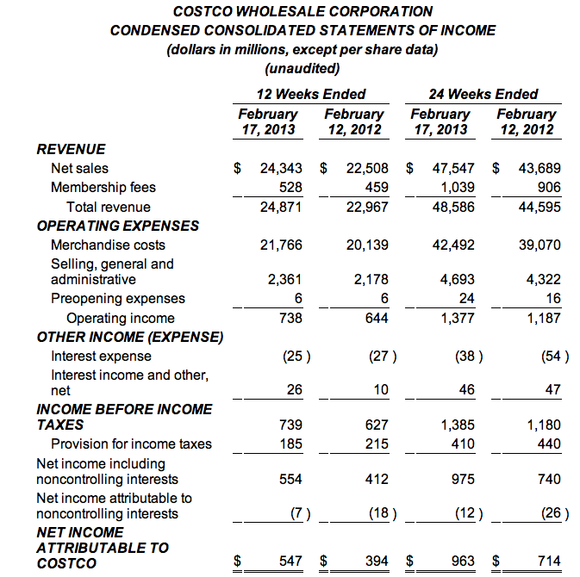

(Costco’s Second-Quarter Earnings Release)

The sizable increase in net income can in part be attributed to a $62 million tax benefit that was related to the company’s special-cash dividend paid in December, but can also be seen as tangible evidence for the success of the company’s operating platform that brings low-price bulk goods to families around the world. From an investment perspective, Costco Wholesale Corporation (NASDAQ:COST) is a company that has rewarded shareholders in the past with high returns through dividends and market appreciation. The company’s second-quarter only reassures that Costco is a retail operator prepared to compete in the new age of retail.

The golden egg for Costco

Costco Wholesale Corporation (NASDAQ:COST) has several advantages that place it in a strong position to outperform its retail counterparts, Target Corporation (NYSE:TGT) and Wal-Mart Stores, Inc. (NYSE:WMT). The first advantage that Costco has is its incredible membership network that represents a significant portion of the retailers annual profit. Members pay as much as $110 per year to shop in Costco and these membership fees represented $528 million in the second quarter alone. This 15% increase in membership income speaks to the company’s appeal to consumers, but also says something about the manner in which Costco achieves its profitability. Unlike most retailers that drive profitability through margins, Costco does so through membership fees. For example, Target and Wal-Mart Stores, Inc. (NYSE:WMT) alike must rely on steady margins in order to achieve EPS growth. Although Costco must also do so, the focus on membership growth is a more consistent and easier to control revenue stream. This gives Costco a much steadier and easier means to predict income. For investors, this means a company that has a more secure track to profitability.