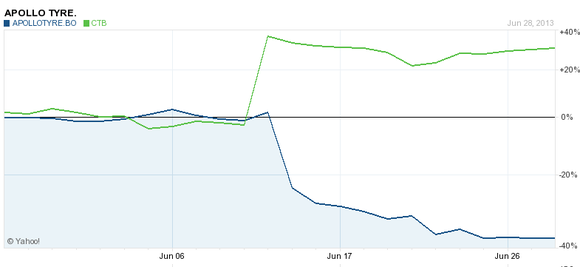

That investors punished Apollo after the announced acquisition of Cooper Tire & Rubber Co (NYSE:CTB) for $2.5 billion in cash is not new in financial markets. In most acquisitions, the shareholders of the target firm walk away with great benefits and the markets punish the acquirer stating, ‘Did you pay too much?’

The graph below demonstrates the stock price movements of both the companies before and after announcement of the acquisition deal.

Does it make sense to acquire a company in a developed market, or should Apollo have tried acquiring a company in a fast growing market?

The combined entity will be uniquely positioned to leverage its well established brands – Cooper Tire & Rubber Co (NYSE:CTB), Apollo and Vredestein – and will have large market access through established markets, such as the USA and Europe, and emerging markets, such as India, China, Africa and Latin America. The acquisition will also allow targeting more segments – the passenger car, light and heavy truck and farm and highway vehicles.

The synergies could be in the form of operational or financial synergies. I believe that the following points illustrate, broadly, the synergies between Apollo and Cooper Tire & Rubber Co (NYSE:CTB).

Operating synergy:

- Economies of scale : The combined entity will have advantages in terms of cost-efficiency through raw material procurement

- Higher growth : The combined firm will be able to introduce products and brands in each other’s markets

- Functional strengths: The two companies bring their strengths in technology, R&D and other functional areas where there could be overlap

Financial synergy:

- Debt capacity: The combined firm will have more capacity to take debts. In this case, the holding company will issue bonds worth $2.1 billion, which would be serviced by Cooper Tire & Rubber Co (NYSE:CTB) and its European operations. The rest, $450 million, will be raised at its Mauritian subsidiary and will be serviced by the Indian operations

The book value of equity of Cooper = $815.9 M[1]

Market value of Cooper before acquisition = 63.34 M[2] * 24.56[3]= $1553.6 M

Acquisition price of Cooper = 63.34*35 = $2216.9 M

Premium paid for acquisition = $661.2 M

The management estimates that they will be able to generate savings in the range of $80 M-$120 M per year from the third year onward.

Assuming managements’ best estimate of $120 M in saving, we valued synergy, and it comes around $700.5 M[4]

It seems that the premium of $661.2 M paid was reasonable. Why did Investors punish Apollo then?

The answer lies not in the premium paid, but the way it is paid i.e. the huge debt burden that could strain the balance sheet of the combined entity

The competition

The North American operation is highly competitive and Cooper Tire & Rubber Co (NYSE:CTB) faces stiff competition from Bridgestone, The Goodyear Tire & Rubber Company (NASDAQ:GT) and Groupe Michelin. These competitors are substantially larger than Cooper Tire & Rubber Co (NYSE:CTB) and serve OEMs as well as replacement tire market. Apollo-Cooper will face the heat of the competition in both North American and Asian markets.