Conestoga Capital Advisors, an asset management company, released its “Mid-Cap Strategy” first-quarter 2024 investor letter. A copy of the letter can be downloaded here. It was a solid quarter as many asset classes moved higher. The S&P Index, which tracks the performance of large-cap stocks, reached an all-time high on March 28th, and the Russell 2000 Index, which tracks the performance of small-cap stocks, appreciated to within 10% of their peak levels. The Mid Cap Composite rose 5.44% net of fees in the first quarter, compared to a 9.50% return for the Russell Midcap Growth Index. Stock selection was the leading performance detractor in the quarter. In addition, please check the fund’s top five holdings to know its best picks in 2024.

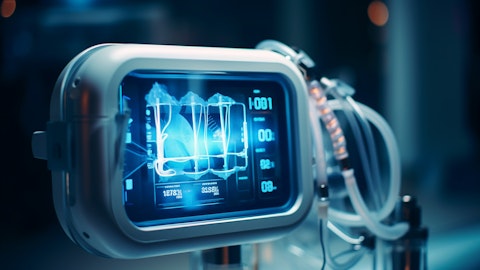

Conestoga Capital Advisors Mid-Cap Strategy highlighted stocks like Teleflex Incorporated (NYSE:TFX), in the first quarter 2024 investor letter. Teleflex Incorporated (NYSE:TFX), with a market capitalization of $10.037 billion, designs, develops, manufactures, and supplies single-use medical devices. One-month return of Teleflex Incorporated (NYSE:TFX) was 3.09%, and its shares lost 8.61% of their value over the last 52 weeks. On May 22, 2024, Teleflex Incorporated (NYSE:TFX) stock closed at $213.09 per share.

Conestoga Capital Advisors Mid-Cap Strategy stated the following regarding Teleflex Incorporated (NYSE:TFX) in its first quarter 2024 investor letter:

“Teleflex Incorporated (NYSE:TFX): Based in suburban Philadelphia, TFX is a leading manufacturer and supplier of medical devices for diagnostic and therapeutic procedures. TFX reported better-than-expected revenues and earnings for the fourth quarter of 2023. The company demonstrated solid performance during the quarter but the contraction of its operating margins caused considerable concern among investors. The company’s significant growth investments and its recent Palette acquisition are pressuring operating margins in 2024. We believe these two factors may fade over the next year.”

A doctor in their office, consulting with a patient about the benefits of the company’s interventional urology products.

Teleflex Incorporated’s (NYSE:TFX) trailing 12 months revenue is $3 billion. Teleflex Incorporated’s (NYSE:TFX) total revenue in the first quarter was $737.8 million, a 3.8 % increase from 2023 first quarter.

Teleflex Incorporated (NYSE:TFX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 24 hedge fund portfolios held Teleflex Incorporated (NYSE:TFX) at the end of the first quarter which was 20 in the previous quarter.

In another article, we discussed Teleflex Incorporated (NYSE:TFX) and shared the list of most valuable medical device companies in the US. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

If you are looking for an AI stock that is as promising as Microsoft but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.