We recently compiled a list of the 10 Best Dividend Stocks of All Time. In this article, we are going to take a look at where Consolidated Edison, Inc. (NYSE:ED) stands against the other dividend stocks.

Dividend stocks aren’t a quick fix for investing; they offer lasting rewards over time. Unfortunately, many investors miss the boat on this and expect to strike it rich overnight. When that doesn’t pan out, they chase the latest stock market trends, ignoring the steady gains that dividend stocks can provide. This trend has been evident over the past year, with AI stocks taking the spotlight and leaving income stocks in the dust. However, there’s a silver lining: many tech companies have begun offering dividends this year, highlighting their long-term potential.

The current yields of these tech stocks might be small, which leads many income investors to overlook their impressive growth records. This is unfortunate because dividend growth can significantly boost both long-term income and capital gains. Analysts believe that dividend growth and sustainability are more crucial than just the yield. For instance, Microsoft’s roughly 864% return over a decade far outpaces the returns from non-tech stocks like AT&T and Chevron, despite their higher yields. The tech giant currently pays $0.75 per quarter and offers a dividend yield of 0.7%. However, you need to keep in mind that its quarterly dividend was $0.28 a decade ago and its dividend yield was 2.5%. Despite the nearly tripling its quarterly dividend, the stock’s yield went down to 0.7% and that was a great thing for its dividend investors.

Dividend stocks are often compared not just with high-yield stocks but also with those that don’t pay dividends to provide investors with a comprehensive view. According to data from Hartford Funds, from 1973 to 2023, dividend-paying companies offered an average annual return of 9.17%, while stocks without dividends only returned 4.27%. The report also noted that companies with stable dividends had an average return of 6.74%, which lagged behind the performance of companies that increased their dividends.

While regularly increasing dividends is challenging, maintaining consistent payouts year after year is also no easy feat for companies. Analysts warn against yield traps—stocks with high yields but unstable dividend policies. Brian Bollinger, president of Simply Safe Dividends, shared his views on dividend investing in a CNBC interview. He recommended focusing on top-quality companies, which often provide dividend yields of around 3% to 4%. These firms usually show steady growth in their dividend payments, boosting the annual income stream and helping to counteract inflation. He also pointed out that stocks with lower yields tend to be safer investments with more reliable payout structures.

In this article, we will take a look at some of the best dividend stocks of all time that have consistent records of paying dividends to shareholders.

Our Methodology:

For this article, we scanned the list of companies that have paid dividends to shareholders for at least 75 years. From that list, we picked companies with dividend yields of above 2%, as of July 23. We analyzed these companies through their balance sheets and overall financial health to determine their dividend stability. Additionally, we assessed the sentiment of hedge funds for each stock using Insider Monkey’s Q1 2024 database. The stocks are arranged in ascending order based on the number of hedge funds that hold stakes in these companies. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here).

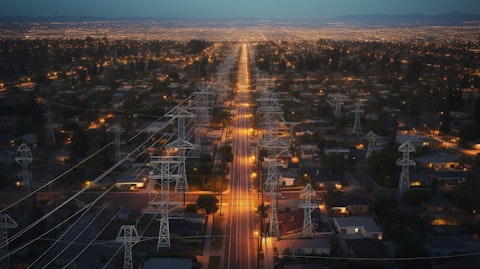

Aerial view of transmission and distribution substations providing electricity to residential and commercial customers.

Consolidated Edison, Inc. (NYSE:ED)

Number of Hedge Fund Holders: 35

Dividend Yield as of July 23: 3.52%

An American energy company, Consolidated Edison, Inc. (NYSE:ED) ranks seventh on our list of the best dividend stocks of all time. The company has been a solid dividend payer since 1885, never missing a beat when it comes to returning cash to shareholders. It has increased its payouts for 50 straight years, weathering six U.S. recessions along the way. Over this period, it has raised its payouts at a compound annual growth rate of nearly 6%. This track record proves that the company has its ducks in a row and is firmly on solid ground, consistently delivering reliable dividends to its investors. The company offers a quarterly dividend of $0.83 per share and has a dividend yield of 3.52%, as of July 23.

Consolidated Edison, Inc. (NYSE:ED) is one of the best dividend stocks of all time because the company is committed to meeting its shareholder commitments by planning to distribute 55% to 65% of its adjusted earnings as dividends, down from the previous target of 60% to 70%. The company aims to keep a larger portion of its earnings to support internal growth. This strategy is expected to boost earnings per share growth, potentially leading to higher total returns by combining dividend income with stock price gains as earnings rise.

Income investors frequently prefer utility companies due to their reliable cash flows, which are supported by steady demand and government-regulated pricing. Consolidated Edison, Inc. (NYSE:ED)’s first-quarter earnings highlight the strong rate base growth it expects for its utilities up until 2028. This growth is fueled by investments aimed at safeguarding equipment from climate change and developing an electric grid that can deliver 100% clean energy.

The number of hedge funds tracked by Insider Monkey owning stakes in Consolidated Edison, Inc. (NYSE:ED) jumped to 35 in Q1 2024, from 28 in the preceding quarter. These stakes are collectively valued at roughly $445 million. Among these hedge funds, D E Shaw was the company’s largest stakeholder in Q1.

Overall ED ranks 7th on our list of the best dividend stocks to buy. You can visit 10 Best Dividend Stocks of All Time to see the other dividend stocks that are on hedge funds’ radar. While we acknowledge the potential of ED as an investment, our conviction lies in the belief that some deeply undervalued dividend stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for a deeply undervalued dividend stock that is more promising than ED but that trades at less than 7 times its earnings and yields nearly 10%, check out our report about the dirt cheap dividend stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and 10 Best of Breed Stocks to Buy For The Third Quarter of 2024 According to Bank of America.

Disclosure: None. This article is originally published at Insider Monkey.