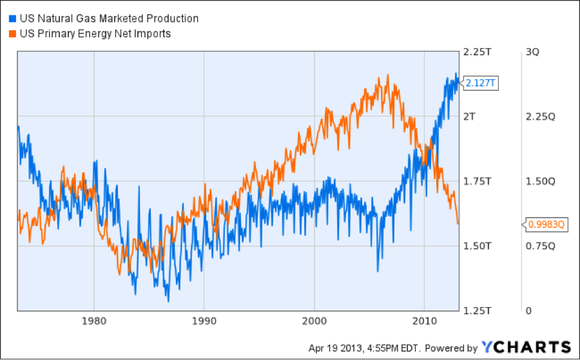

Natural gas producers were picked specifically because the energy boom is in the process of transforming the United States toward a path of greater energy independence. Over the long-term, this trend is expected to continue. With power plants switching over from coal to natural gas, demand seems likely to be strong into the foreseeable future.

A number of natural gas producers were screened with this investment thesis in mind. Apache Corporation (NYSE:APA) is one of the largest independent exploration and production companies in the United States. The company derives approximately equal portions of its revenue from natural gas and liquids with 2.99 billion barrels oil equivalent (BOE) in proven reserves. Apache Corporation (NYSE:APA) trades below tangible book value, which did not occur even during the 2008 bear market.

CNOOC Limited (ADR) (NYSE:CEO) engages in the same activities, with much of its production offshore of the Chinese mainland. With a market capitalization of nearly triple that of Apache it has proven reserves only slightly more at 3.19 BOE. Because natural gas prices have traded considerably lower in the United States, the valuation is a good bit higher in terms of price/book. Still growth of its book value has been a robust 21.79% annualized over the past five years. With a solid dividend yield CNOOC Limited (ADR) (NYSE:CEO) is an interesting play on emerging market growth in natural gas production. It should also be noted that natural gas is approximately 25% of the company’s revenue. Thus, CNOOC Limited (ADR) (NYSE:CEO) is somewhat more comparable to a Chinese Exxon than a pure play natural gas producer.

Chesapeake Energy Corporation (NYSE:CHK) is likely the most widely known company on this list and ran into some controversy with the CEO borrowing against his stake in company wells via loans that were not disclosed to shareholders. Since the company has been forced to divest itself of assets. While the company appears cheap, prior management indiscretions still seem like a good reason to avoid the shares.

EnCana Corporation (USA) (NYSE:ECA) is still one of the largest natural gas producers, but has suffered substantial declines in revenue and per share book value over the past several years. Its revenue is less diversified, with 93% coming from natural gas and its debt ratio has been on the rise as natural gas prices have retreated. While prices could rebound strongly along with natural gas, the company seems to be higher in risk.

Finally, EOG Resources Inc (NYSE:EOG) has a good deal less in proven reserves as a proportion of its market capitalization with 1.81 BOE in 2012. The share price has held up well, even given the lower profitability of the company over the past several years. As such, it appears that the valuation is not discounting the lower price of natural gas to the same extent as other companies.