Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Concho Resources Inc. (NYSE:CXO), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

Is Concho Resources Inc. (NYSE:CXO) a great investment right now? Money managers are becoming hopeful. The number of bullish hedge fund bets advanced by 2 lately. Our calculations also showed that CXO isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a glance at the new hedge fund action encompassing Concho Resources Inc. (NYSE:CXO).

How have hedgies been trading Concho Resources Inc. (NYSE:CXO)?

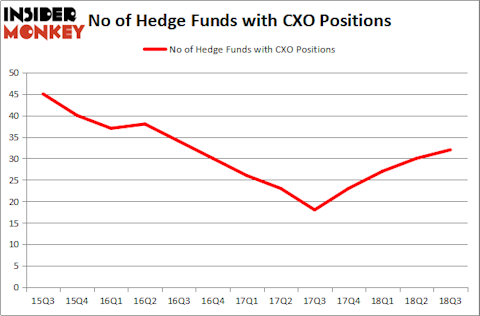

At Q3’s end, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CXO over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in Concho Resources Inc. (NYSE:CXO) was held by Adage Capital Management, which reported holding $91.6 million worth of stock at the end of September. It was followed by Millennium Management with a $63.5 million position. Other investors bullish on the company included Point State Capital, Alyeska Investment Group, and Two Sigma Advisors.

Now, key hedge funds have been driving this bullishness. Adage Capital Management, managed by Phill Gross and Robert Atchinson, initiated the most valuable position in Concho Resources Inc. (NYSE:CXO). Adage Capital Management had $91.6 million invested in the company at the end of the quarter. Rob Citrone’s Discovery Capital Management also made a $31.4 million investment in the stock during the quarter. The other funds with brand new CXO positions are Ken Heebner’s Capital Growth Management, Jorge Paulo Lemann’s 3G Capital, and Ryan Pedlow’s Two Creeks Capital Management.

Let’s now review hedge fund activity in other stocks similar to Concho Resources Inc. (NYSE:CXO). These stocks are Canadian Pacific Railway Limited (NYSE:CP), Advanced Micro Devices, Inc. (NYSE:AMD), TD Ameritrade Holding Corp. (NYSE:AMTD), and NetEase, Inc (NASDAQ:NTES). This group of stocks’ market caps are closest to CXO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CP | 30 | 2732916 | 5 |

| AMD | 28 | 600368 | 1 |

| AMTD | 18 | 575391 | -10 |

| NTES | 26 | 3081199 | 2 |

| Average | 25.5 | 1747469 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.75 billion. That figure was $547 million in CXO’s case. Canadian Pacific Railway Limited (NYSE:CP) is the most popular stock in this table. On the other hand TD Ameritrade Holding Corp. (NYSE:AMTD) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Concho Resources Inc. (NYSE:CXO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.