Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 24.4% during the first 9 months of 2019 and outperformed the broader market benchmark by 4 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

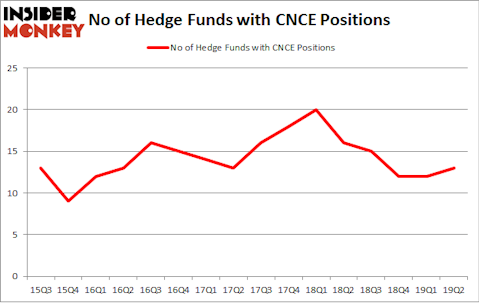

Concert Pharmaceuticals Inc (NASDAQ:CNCE) was in 13 hedge funds’ portfolios at the end of the second quarter of 2019. CNCE has experienced an increase in activity from the world’s largest hedge funds recently. There were 12 hedge funds in our database with CNCE positions at the end of the previous quarter. Our calculations also showed that CNCE isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are seen as worthless, old investment tools of yesteryear. While there are over 8000 funds with their doors open at the moment, Our experts look at the bigwigs of this club, around 750 funds. These hedge fund managers direct most of the smart money’s total capital, and by tailing their highest performing investments, Insider Monkey has deciphered numerous investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the recent hedge fund action encompassing Concert Pharmaceuticals Inc (NASDAQ:CNCE).

What does smart money think about Concert Pharmaceuticals Inc (NASDAQ:CNCE)?

At Q2’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the first quarter of 2019. On the other hand, there were a total of 16 hedge funds with a bullish position in CNCE a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Concert Pharmaceuticals Inc (NASDAQ:CNCE) was held by Perceptive Advisors, which reported holding $26.5 million worth of stock at the end of March. It was followed by Biotechnology Value Fund / BVF Inc with a $19.5 million position. Other investors bullish on the company included Renaissance Technologies, Millennium Management, and Alyeska Investment Group.

As one would reasonably expect, some big names were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most outsized position in Concert Pharmaceuticals Inc (NASDAQ:CNCE). Marshall Wace LLP had $1.2 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also made a $0.2 million investment in the stock during the quarter. The only other fund with a brand new CNCE position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks similar to Concert Pharmaceuticals Inc (NASDAQ:CNCE). We will take a look at WhiteHorse Finance, Inc. (NASDAQ:WHF), Marlin Business Services Corp. (NASDAQ:MRLN), Energy Fuels Inc (NYSE:UUUU), and Ocwen Financial Corporation (NYSE:OCN). This group of stocks’ market values are similar to CNCE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WHF | 5 | 5089 | 2 |

| MRLN | 3 | 99982 | -2 |

| UUUU | 9 | 16295 | 2 |

| OCN | 10 | 32774 | -5 |

| Average | 6.75 | 38535 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $70 million in CNCE’s case. Ocwen Financial Corporation (NYSE:OCN) is the most popular stock in this table. On the other hand Marlin Business Services Corp. (NASDAQ:MRLN) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Concert Pharmaceuticals Inc (NASDAQ:CNCE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CNCE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CNCE were disappointed as the stock returned -51% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.