As I mentioned before, changing global climate has wrought havoc on the agricultural sector during the past year. Drought in the United States has stunted the yields of many crops, while unusual weather patterns elsewhere in the world led to sharp spikes — and drops — in farm yields across Asia, Latin America and Europe.

Yet it’s unwise to pay too close attention to these near-term events. Instead, focus on the clear long-term trend in place for global agriculture: Millions more people are joining the middle class in fast-growing places such as China, Brazil and India, and there is a global push to ensure crop yields are maximized to meet this rising demand.

And the most surefire way to maintain robust farm output is through the judicious use of fertilizer. There are several key components to fertilizer, most notably potash and phosphate, both of which help soil to stimulate the ideal growing conditions for healthy crops.

The oligopoly pricing

Just a handful of companies around the world control the production of key fertilizers such as potash and phosphate. For example, the top 10 producers of potash control 85% of the entire global market. In effect, it is an oligopolistic market. This means the fertilizer industry’s output is often tightly controlled, so pricing — to an extent — is managed. I say “to an extent” because demand also affects pricing, and the cost of items such as phosphate and potash can swing from year-to-year.

If you took a broad snapshot of the global agricultural market, then you’d find that expected growing conditions in 2013 will be “fair to good,” with pricing for fertilizer at or slightly above historical trends. For example, potash prices are likely to remain in a range of $450 to $500 per ton.

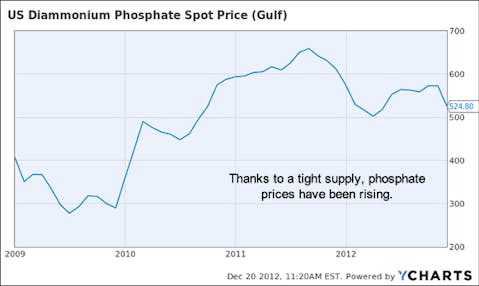

The outlook for phosphate pricing is a bit firmer, in part because the Moroccan government has sought to keep a lid on phosphate output in that country, which is the world’s largest producer of this fertilizer raw material. As the chart below shows, phosphate prices have been steadily rising in the past few years thanks to tight supply.

US Diammonium Phosphate Spot Price (Gulf) data by YCharts

One of the few companies to have a hand in both of these chemicals is Mosaic Co (NYSE:MOS), which controls roughly 13% of the phosphate and potash markets. Mosaic’s market share in potash is set to soar thanks to expansion plans that will boost output capacity by 2.8 million tons and more plans to develop an additional 1.3 million tons of capacity. Mosaic is also pursuing similar, albeit more modest expansions in its phosphate production.

Mosaic isn’t simply a play on U.S. farming. It sells 20% of its output to Brazil, another 14% to India, 7% of output to Canada and another quarter of its output to countries outside the United States.

Mosaic’s planned expansions, which should boost sales and cash flow steadily in coming years, is just one catalyst for this stock. Shares should also get a lift in the summer of 2013 when the company will no longer be restricted in what it can do with a current $3.2 billion cash pile sitting on its balance sheet. That should set the stage for a robust hike in its dividend, or a major stock buyback program.

Yet in the near-term, this remains as an out-of-favor stock, as key trading partners such as India and China have been slow to sign new contracts in order to gain leverage in pricing conditions. The delays are expected to end this winter as these countries seek fresh long-term supply agreements.

The share price pullback has left Mosaic trading at very appealing levels. Shares trade for around 6.5 times projected 2013 EBITDA, on an enterprise value basis. This multiple shrinks below six if you look out to 2014 and beyond, when Mosaic’s output begins to rise meaningfully.

A broader fertilizer play

If you would rather exposure to more than just potash and phosphate, then check out Sociedad Quimica y Minera (NYSE:SQM). Not only is the company a major producer of phosphate and potash, but Chemical Mining also is a leading miner of lithium, which is used in today’s hybrid and electric car batteries. The company is also a leading global producer of iodine and sodium nitrate, which have myriad end-market uses.

That exposure to a broad number of markets has led to steady growth in operating profits, which have almost tripled from about $250 million in 2007 to $730 million in 2011. Merrill Lynch’s analysts predict operating profits will surge 20% this year and another 10% in 2013. Equally important, this high level of profitability can be maintained because Chemical Mining has some of the youngest (and largely untapped) mines in the industry.

Risks to Consider: The Chinese government negotiates potash and phosphate prices on behalf of its domestic farmers and could seek new contracts at lower prices. This would negatively affect Mosaic’srevenue from that country.

Action to Take –> With fertilizer stocks, it’s important to heed the long-term global trend in farming. Many countries are boosting their agricultural production capacity to feed an ever-hungrier population that consumes a rising amount of food with each passing year. This makes farm inputs such as phosphate and potash an essential long-term commodity, which should help Mosaic and Chemical Mining to post solid annual results year-after-year.

This article was originally written by David Sterman, and posted on StreetAuthority.