The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Collegium Pharmaceutical, Inc. (NASDAQ:COLL).

Is Collegium Pharmaceutical, Inc. (NASDAQ:COLL) a buy here? The best stock pickers are turning less bullish. The number of bullish hedge fund bets were cut by 2 recently, and there were 15 smart money investors with long holdings of the stock at the end of Q3. Seeing less hedge fund optimism for the stock in the recent period, it is not a surprise that it is far from being one of the 30 most popular stocks among hedge funds in Q3 of 2018. So, what does this mean exactly? That we shouldn’t consider this stock or analyze it furthermore? Absolutely not, we need more examination before we can determine if Collegium Pharmaceutical, Inc. is a good buy or not.

At the moment there are dozens of tools shareholders put to use to grade publicly traded companies. Two of the best tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite money managers can outperform the broader indices by a healthy amount (see the details here).

While researching about the company, we stumbled upon Summers Value Partners’ 3Q Investor Letter, in which this boutique value manager discusses its position in the company. We bring you that part of the letter:

“Collegium Pharmaceuticals (COLL) represents the largest unrealized loss in the portfolio, and in the interest of transparency, I would like to provide some brief comments on our thoughts regarding this position. We have added to Collegium only slightly on weakness, and it currently represents the smallest position in the fund — by a wide margin — as it has since we initiated the position in June. We bought Collegium on the thesis that the company’s main product, Xtampza ER, was a vital part of the solution to America’s opioid crisis, and that the market was not giving the company credit for a better-than-expected sales outlook. However, we committed a cardinal sin by overpaying for the stock when it was trading at a 52-week high (and near an all-time high). We vastly prefer to accumulate stocks that are trading at multi-year lows and carry below-average investor expectations. Collegium is also a reminder that we prefer to own companies that have a history of positive cash flow generation because cash flow creates optionality in periods of underperformance. Whereas the company has a reasonable and growing sales base, it is not profitable at this juncture. We do expect the company to become profitable in 2019, but in the meantime, we have been dealt a sizeable loss because we violated the margin of safety tenant of our process. Notwithstanding this setback, our intention is to keep the position size small as we wait for business performance to improve driven by increased market access for Xtampza ER.”

It is interesting to note that despite the loss in the Summers Value Partners’ portfolio created thanks to its position in Collegium Pharmaceutical, Inc, it still has some enthusiasm for the stock, as it expects it to become profitable next year.

Continuing with our analysis, we’re now going to take a look at the latest hedge fund action regarding Collegium Pharmaceutical, Inc. (NASDAQ:COLL).

How have hedgies been trading Collegium Pharmaceutical, Inc. (NASDAQ:COLL)?

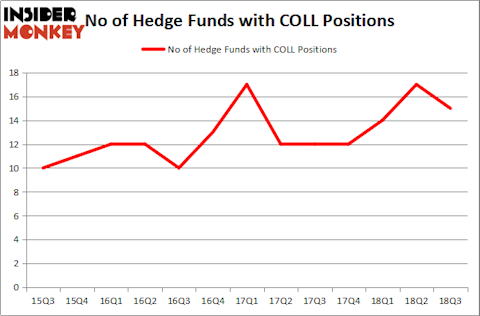

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards COLL over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

More specifically, Sectoral Asset Management was the largest shareholder of Collegium Pharmaceutical, Inc. (NASDAQ:COLL), with a stake worth $29.3 million reported as of the end of September. Trailing Sectoral Asset Management was Frazier Healthcare Partners, which amassed a stake valued at $27.8 million. Rock Springs Capital Management, Maverick Capital, and Highland Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Collegium Pharmaceutical, Inc. (NASDAQ:COLL) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there is a sect of money managers that slashed their full holdings in the third quarter. Interestingly, John Osterweis’s Osterweis Capital Management cut the largest position of the 700 funds monitored by Insider Monkey, worth an estimated $5.4 million in stock, and Chuck Royce’s Royce & Associates was right behind this move, as the fund cut about $3.3 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Collegium Pharmaceutical, Inc. (NASDAQ:COLL) but similarly valued. These stocks are pdvWireless, Inc. (NASDAQ:PDVW), Clearwater Paper Corporation (NYSE:CLW), Ultra Clean Holdings, Inc. (NASDAQ:UCTT), and TORM plc (NASDAQ:TRMD). This group of stocks’ market caps match COLL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PDVW | 9 | 227471 | 0 |

| CLW | 10 | 25615 | 3 |

| UCTT | 8 | 27515 | -2 |

| TRMD | 2 | 313766 | 1 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $149 million. That figure was $104 million in COLL’s case. Clearwater Paper Corporation (NYSE:CLW) is the most popular stock in this table. On the other hand TORM plc (NASDAQ:TRMD) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Collegium Pharmaceutical, Inc. (NASDAQ:COLL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.