We recently published a list of Complete List of All AI Companies Under $2 Billion Market Cap. In this article, we are going to take a look at where Cohu, Inc. (NASDAQ:COHU) stands against other AI companies under $2 billion market cap.

It’s clear that AI holds immense promise but it comes with significant risks. Some of the concerns that the market has include overreliance on a few key players, shifts in demand toward smaller competitors, and the broader impact of AI-driven market trends on earnings and valuations. While AI offers opportunities, managing risks such as customer concentration, economic headwinds, and market volatility will be crucial for its sustainable growth and integration.

Navigating AI Expectations and Market Dynamics

On CNBC ‘Fast Money,’ a discussion between traders highlighted concerns about elevated expectations for AI, especially in the chip market, with NVDA as a prime example. Past patterns in the semiconductor giant’s stock suggest potential declines, with customer concentration being a significant risk. Some believe demand for high-end chips could shift to smaller semiconductor companies. They also discussed that broader market performance might improve as other sectors gain traction, especially during earnings season, which is expected to influence investor sentiment more than AI and GLP-1 trends.

They mentioned that the key risks for earnings include the strong U.S. dollar, rising rates, and policy uncertainties, which may impact large-cap companies. While recent PPI data offered some relief, the bond market remains firm, with 10-year yields approaching 5%. Expectations for CPI and PCE figures are mixed, with potential reacceleration seen as a headwind for markets in a higher rate environment. Earnings and economic data were considered critical factors to watch by the traders.

Our Methodology

For this article, we scoured our database as well as several ETFs and media reports to find all possible AI stocks under $2 billion. We then listed the stocks in ascending order of their market cap. We also added the hedge fund sentiment around each stock which was taken from Insider Monkey’s database of 900 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

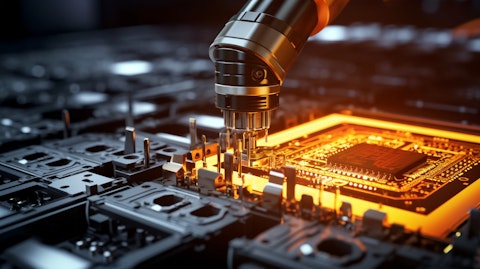

A robotic arm placing a semiconductor chip on a test contactor.

Cohu, Inc. (NASDAQ:COHU)

Market Capitalization: $1.17 Billion

Number of Hedge Fund Holders: 10

Cohu, Inc. (NASDAQ:COHU) supplies semiconductor test equipment and services globally, including in China, the U.S., Taiwan, Malaysia, and the Philippines. Its offerings include test handlers, MEMS test modules, thermal subsystems, and automated test equipment for wafer-level and package testing. The company also provides DI-Core, a data analytics software suite for real-time performance monitoring and process control.

In December 2024, Cohu (NASDAQ:COHU) announced an agreement to acquire Tignis, Inc., a company specializing in AI-driven process control and analytics software. The acquisition allows Cohu to strengthen its analytics capabilities and tap into the $2.6 billion semiconductor process control market, targeted by Tignis’ PAICe Monitor and PAICe Maker solutions. These innovative tools use AI, machine learning, and data science to offer predictive and prescriptive automation for semiconductor manufacturing.

Tignis will also help strengthen the company’s expertise in data science and improve its DI-Core software. PAICe Monitor uses AI for anomaly detection and predictive maintenance, while PAICe Maker automatically adjusts manufacturing processes to reduce variability and maintenance costs. The acquisition, funded with cash on hand, is set to close in January 2025.

Overall, COHU ranks 7th on our list of the 59 AI companies under $2 billion market cap. While we acknowledge the potential of COHU as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than COHU but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stock To Buy Now and 30 Most Important AI Stocks According to BlackRock

Disclosure: None. This article is originally published at Insider Monkey.