Scott Wells: So, so Lance, the, the comment was directed at programmatic. It was our, it was our best month ever in, in programmatic. So, that was not, that was not indicative of, of the overall business. So, it was a little narrower, I think, than you might have interpreted.

Lance Vitanza: And then is the momentum that you’re taking, you know, that you’re seeing, is that, are you taking share from other out of home advertisers or is, is the out of home medium taking share from other media or are you just sensing a general improvement in, in ad spending than you had forecast?

Scott Wells: So, I do think that out of home certainly relative to traditional media is, is gaining share relative to traditional media. You know, you’ve heard the digital companies report and they’ve had pretty good results. So, not, not going to say that we’re taking a lot from that channel, but I think it’s, I think it’s an optimization thing. We are a relatively small part of the media ecosystem and advertisers are very much trying to figure out the optimal mix of media. And what we have is a high reach, hardworking medium that a lot of advertisers know us well and use us in that regard. And they’re seeing the synergies that we’ve called out with digital media in particular, pretty regularly. And so, we’re seeing ourselves get included in campaigns alongside those — those sort of media.

And I think that’s an important growth driver for us going forward. But it’s very hard to generalize across the thousands and thousands of advertisers. I do think that we’re well positioned as a hardworking, high reach medium.

Lance Vitanza: And then the last one for me, just to come back to airports for a second. You mentioned that you’re ending the year, you know, stronger than you’d expected. And I’m just wondering if we could sort of think about what the drivers are there. I see three sources of potential upside, right? You could more displays in place than you thought, more passengers passing through the airports than you thought, or advertisers just, embracing the medium, more so than perhaps you’d budgeted. So, of those three, or maybe there are others that I’m missing here, but how would you sort of attribute the relative strength that you’re seeing versus what you had been thinking earlier in the year? Thanks.

Scott Wells: Thanks, Lance. Look, I think it’s all three, but let me unpack it just a little bit for you. I’d add a fourth, which is just timing of inventory deployment. So, we knew this year was going to be strong for airports because we had very, very strong build out. You just look at the CapEx that we deployed in airports the prior periods. We’ve had very strong build out, particularly in our New York franchise. And so, part of it is just mainstreaming a bunch of inventory that’s come online in the last 12 months. But when I think about it, you know, airport traffic is up double digits relative to 2022. It’s really left 2019 in the dust at this point. That was what we used to really fixate on. It’s really now, growing in its own right.

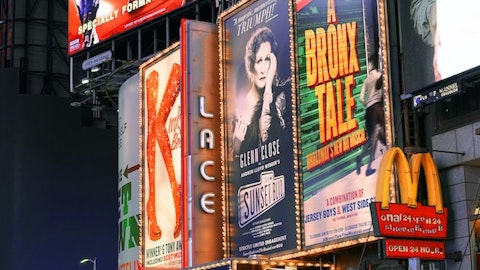

So, it’s up double digits. The digitization has continued, and we talked about that a minute ago. And just in terms of advertisers, it’s been well suited to the advertising market. I’ve referred a number of times to how 2023 has been a super-premium market, which means spectaculars. It means airports. It means iconic locations in iconic places. Whether that’s in New York or Miami or L.A. or Vegas, that part of the market has been red, red hot and airports has benefited from that dynamic. But I think those three things that you named all contributed along with us bringing online a lot of great inventory in New York.