Waste Management, Inc. (NYSE:WM) is not a name that gets thrown around too much. After all, how profitable can you be if you deal in trash? Turns out you can be very profitable. In fact, the company may be seeing its best years ahead and here’s why.

On a positive note, the first reason is that their fixed residential income segment is increasing with the gains seen in the housing market recently. I expect this trend to continue for several years.

But on a tragic note, super storm Sandy caused a lot of destruction. People need to clean up and who’s job is it to haul all that stuff away and dispose of it properly? Why Waste Management’s of course. Once everything is cleaned up then we have the reconstruction boom. Construction debris will now increase in volume over what it had traditionally been. Now couple that with the housing recovery and that spells a lot of cleanup. Good things are on the horizon for Waste Management, so should we jump in? Well let’s make sure it’s a good buy at these levels first.

Figure 1 shows all the vital statistics. With a P/E of 18.28 vs. an industry average of 18 it seems to be in line. It has a yield in line with the industry as well with a 4.20% vs an average of 4.50%. However, its payout ratio is 76% vs an average of 80%. It’s also consistently raised dividends in the past and most likely will continue to do so in the future. The company is an out-performer in terms of profit margin, ROA and ROI when compared to its competitors. Just for an extra comparison I also included the stats for Republic Services, Inc. (NYSE:RSG) which is WM’s largest competitor.

| Valuation | WM | RSG | Industry |

| P/E | 18.28 | 17.5 | 18.00 |

| Yield | 4.20 | 3.10% | 4.50% |

| Payout Ratio | 76% | 52% | 80% |

| Net Profit Margin 5 Year Average | 8.00% | 7.80 | 5.00% |

| Return on Assets 5 Year Average | 4.90% | 2.40 | 2.90% |

| Return on Investment 5 Year Average | 7.20% | 3.30 | 4.70% |

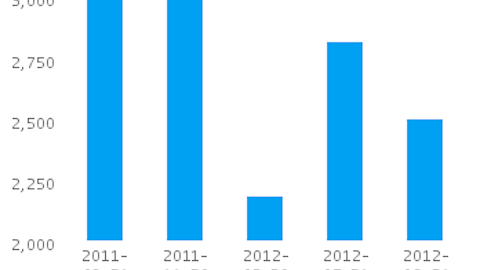

Waste Management has just completed a round of capital spending which is going to benefit their fast growing recycling sector. While the capital spending may put a damper on the next quarter or two it should prove to be a great investment over the long run. Especially when you consider the amount of recycled materials that Waste Management deals in has been up 67% since 2007.

Solid waste volume, stronger pricing, and the completion of an oilfield waste management company which should increase profitability are all reasons to be bullish. Given the $2.28 estimate for next year and the 18.28 PE ratio (in line with the industry) that puts us at $41.67. However, I wouldn’t be one bit surprised if we saw those estimates rise just a bit in the near future.

It’s pretty hard to top landfills in terms of dirty stocks. But those that have driven by a manure plant on a hot summer’s day know that fertilizer can be less than aromatically pleasant.

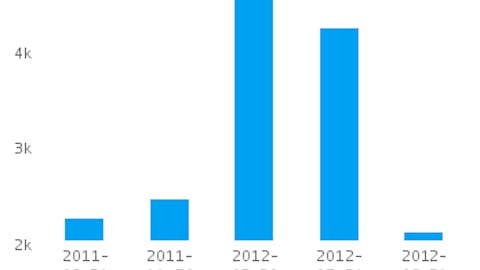

Terra Nitrogen Company, L.P. (NYSE:TNH) and CF Industries Holdings, Inc. (NYSE:CF) aren’t your typical fertilizer plays. They form a symbiotic relationship that has given them the power to increase market share significantly. One pays a healthy dividend and the other has its sights set firmly on growth. So how and why does this team work together?