It is hard to like banks. Much less consider them for your investment portfolio, with all the negativity associated with them. In fact, your friends may mock you at your latest cocktail party just at the mention of Goldman Sachs, or Citigroup Inc (NYSE:C). Despite all the negativity surrounding banks, let’s not forget our number one goal in investing: generating investment yields.

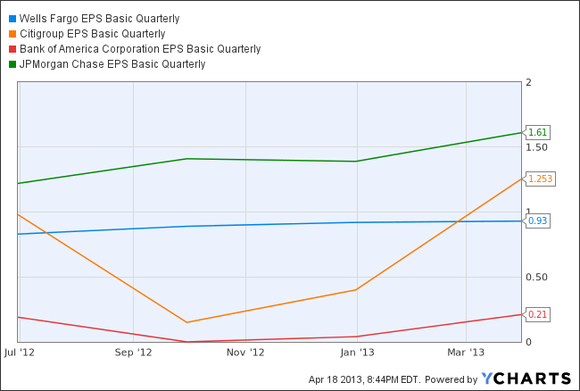

Every major bank reported strong growth figures. The most notable earnings releases were Bank of America’s and Citigroup Inc (NYSE:C)’s. Citigroup Inc (NYSE:C) pulled off 213% quarter-over-quarter EPS growth.

Bank of America’s results were driven by falling costs along with revenue growth in fees. Wells Fargo & Co (NYSE:WFC) reported growth in fee income but generated declining lending revenues. Wells Fargo & Co (NYSE:WFC), Citi, and Bank of America interest income from lending is being negatively affected by the higher capital ratio standards for larger banks. The higher capital ratios decrease the profitability from lending; therefore banks have been relying on alternative financial products in order to sustain growth. The creation and marketing of alternative financial products is the main method by which banks are trying to sustain growth.

The economy is on the mend. As total debt in the United States may have bottomed as the economy has continued to have grown; people are willing to borrow more in order to finance larger purchases. Larger purchases generally involve buying homes, cars, businesses, and other large purchases. Banks may see some revenue growth in the future due to the stabilizing debt levels in the United States economy.

Citigroup earnings were fairly impressive. The company was able to report earnings of $1.29 a share which beat analyst estimates of $1.17 per share. The company was able to report revenues of $20.81 billion, which was even better than the estimates of $20.17 Billion. The company reported interest revenues that declined by 8% year-over-year which has been a general theme for banks. The company was able to off-set losses from interest through fees. In fact, commissions and fee revenues has increased by 13% year-over-year. The company’s operating expenses increased by 1% as revenues grew by 6%. The revenue growth was driven by cross-selling (cross-selling generally involves selling pre-existing customers into other financial products the bank already offers).

Citigroup Inc (NYSE:C)’s net income grew by 30% over quarter 1 2012. The company’s net income growth was primarily driven through aggressive cuts in operating expenses. Citigroup’s provision for credit losses declined by 16%, this was another contributing factor to the sudden earnings surprise. Citigroup’s net-income grew from $2.9 billion to $3.8 billion between the 1st quarter of 2012 to 1st quarter 2013.

The company’s earnings performance was more than satisfactory. The macro-economic picture is a little murky from a lending perspective, but the overall theme that should keep shareholders up-beat is the declining costs associated with bad mortgages, falling litigation related costs, along with moderate growth in lending. Citigroup was also able to sustain revenue growth, unlike its other two counterparts (JP Morgan and Chase, Wells Fargo & Company); the improvement in the bottom line is reflected in the strong performance from its fee division. The over-arching theme is that Citigroup is a compelling investment opportunity.

The article Citigroup Tops On Revenues and Earnings originally appeared on Fool.com and is written by Alexander Cho.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.