It’s tough to know what to make of the telepresence and videoconferencing market. While the earnings slowdown with its leading listed protagonists Polycom (NASDAQ:PLCM) and Cisco Systems, Inc. (NASDAQ:CSCO) is easy to spot, the reasons for it are less obvious. Is it a structural decline or is it just due to some pressures on discretionary IT spending at this stage in the cycle?

Structural Decline?

It seems that one of the very few decisions that Hewlett-Packard Company (NYSE:HPQ) has gotten right in the last few years was the sale of its visual collaboration unit to Polycom in 2011. Many commentators didn’t think it was a good move at the time, especially as Cisco Systems, Inc. (NASDAQ:CSCO) bought Tandberg Television in 2010. Microsoft (NASDAQ:MSFT) wasn’t left out of the party, and its 2011 purchase of Skype made it a player at the low end of the market. Essentially the market was geared up for a battle between Polycom and Cisco at the high end while Microsoft was set to use its positioning to expand Skype at the lower end. Whichever the outcome, video conferencing telepresence was supposed to be here to stay.

The result turned out to be very different. The Tandberg acquisition has proved problematic for Cisco, and few observers think it was a great deal now. Similarly, Skype hasn’t pulled up any trees under Microsoft, and Polycom has been forced into investing in order to generate growth by differentiating its offerings from Cisco. Hewlett-Packard Company (NYSE:HPQ) may well be faced with structural declines in its PC and printer markets but it acted adroitly in selling this unit to Polycom.

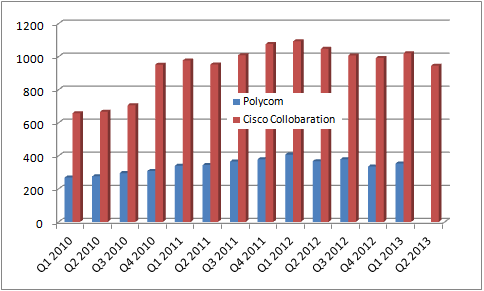

In order to see how badly the industry has fared; here are the revenues for Cisco Systems, Inc. (NASDAQ:CSCO)’s collaboration segment alongside Polycom’s total revenues. The x-axis is based on Cisco’s reporting with Polycom’s numbers adjusted to the most relevant quarter.

Describing the last two years as being challenged would be an understatement, but is it structural?

The argument in favor is that the trend in IT spending is towards software and outsourcing of IT requirements rather than the purchases of in house hardware. Moreover, traditional videoconferencing solutions have tied the purchaser to the solution and requires system-wide integration. It is not in the zeitgeist of open platforms across IT, and as mobility demands ever more corporate IT spending, is a system that requires its users to be in a dedicated room really going to be the future?

Another key trend in IT over the last few years has been virtualization and outsourcing IT into the cloud. Why not do this with videoconferencing? Instead of installing a system that will inevitably require a dedicated room (in each location or node) and then some servicing, why not just buy the service from a cloud based provider and also be able to connect from mobile devices?

Putting these arguments together would conclude that the decline is structural, but it does suggest that solutions like Microsoft’s Skype do have the potential to increase penetration.

Or Is it Just a Cyclical Issue?