Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of Cimarex Energy Co (NYSE:XEC) based on that data.

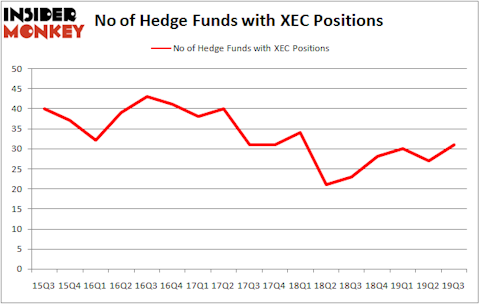

Cimarex Energy Co (NYSE:XEC) investors should be aware of an increase in support from the world’s most elite money managers in recent months. XEC was in 31 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with XEC holdings at the end of the previous quarter. Our calculations also showed that XEC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the 21st century investor’s toolkit there are dozens of tools stock market investors put to use to size up their stock investments. A pair of the most useful tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the elite hedge fund managers can outclass the S&P 500 by a solid margin (see the details here).

Ric Dillon of Diamond Hill Capital

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to check out the fresh hedge fund action regarding Cimarex Energy Co (NYSE:XEC).

How are hedge funds trading Cimarex Energy Co (NYSE:XEC)?

At Q3’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the second quarter of 2019. By comparison, 23 hedge funds held shares or bullish call options in XEC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Cimarex Energy Co (NYSE:XEC) was held by Diamond Hill Capital, which reported holding $299.4 million worth of stock at the end of September. It was followed by International Value Advisers with a $129.5 million position. Other investors bullish on the company included Adage Capital Management, Encompass Capital Advisors, and Deep Basin Capital. In terms of the portfolio weights assigned to each position Encompass Capital Advisors allocated the biggest weight to Cimarex Energy Co (NYSE:XEC), around 7.45% of its 13F portfolio. Deep Basin Capital is also relatively very bullish on the stock, dishing out 5.32 percent of its 13F equity portfolio to XEC.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Cimarex Energy Co (NYSE:XEC) headfirst. Citadel Investment Group, managed by Ken Griffin, created the largest position in Cimarex Energy Co (NYSE:XEC). Citadel Investment Group had $35.4 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $12 million position during the quarter. The following funds were also among the new XEC investors: Vince Maddi and Shawn Brennan’s SIR Capital Management, Clint Carlson’s Carlson Capital, and Didric Cederholm’s Lion Point.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cimarex Energy Co (NYSE:XEC) but similarly valued. These stocks are Ultrapar Participacoes SA (NYSE:UGP), Prosperity Bancshares, Inc. (NYSE:PB), Performance Food Group Company (NYSE:PFGC), and Rexford Industrial Realty Inc (NYSE:REXR). This group of stocks’ market values resemble XEC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UGP | 5 | 45121 | -2 |

| PB | 17 | 89818 | 1 |

| PFGC | 23 | 158474 | 4 |

| REXR | 17 | 68044 | 0 |

| Average | 15.5 | 90364 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $926 million in XEC’s case. Performance Food Group Company (NYSE:PFGC) is the most popular stock in this table. On the other hand Ultrapar Participacoes SA (NYSE:UGP) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Cimarex Energy Co (NYSE:XEC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately XEC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on XEC were disappointed as the stock returned -13.7% so far in 2019 (through 12/23) and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.