Despite being a fast growing business, the restaurant industry also suffered from lower consumer spending, inflation, and an overall weak economy. Now that the economy is improving, the Consumer Confidence Index reached 84.1 in June, which is the highest reading in the last five years. This is evidence of increasing consumer spending and movement towards a booming restaurant sector. Here, I have listed three restaurant companies that have great investment prospects for a growth-oriented portfolio.

Boom in new growth ideas

Recently, Chipotle signed a new deal to debut four ShopHouse units in the U.S. The Los Angeles (Westwood) and Bethesda locations will open in late 2013, while the Rockville and Washington (Verizon Center) locations are scheduled to open in mid-2014. Seeing the popularity of ShopHouse menu items among the younger demographics (18-to-35-year-olds), it is very likely that the company can open as many as 300-400 ShopHouse locations in urban and campus areas in the next ten years.

Same store sales, or SSS, increased only 1% in the first quarter of 2013 due to the slowing economy. To increase SSS, Chipotle Mexican Grill, Inc. (NYSE:CMG) invested in two programs – catering and alcoholic drinks. Catering is a huge market where the company can gain market share. According to a report from Sterne Agee, catering includes an average per person check of $12 and an order for 20 customers amounting to a minimum order of $240. The addition of just one order per store per week can add around 60 basis points to the company’s sales. In its alcoholic drink program, Chipotle is offering new drinks including Patron infused margaritas and other premium drinks that will pair well with menu items, boosting sales.

Additionally, Qdoba’s announcement to close more than 10% of its restaurants, or 67 of its underperforming units out of its 647 units across the U.S., gives Chipotle Mexican Grill, Inc. (NYSE:CMG) an opportunity to gain Qdoba’s lost customers. Qdoba is the company’s largest competitor and the second largest fast casual Mexican chain in the U.S. Chipotle Mexican Grill, Inc. (NYSE:CMG) had 1,447 units in the U.S. (excluding ShopHouse) at the end of the first quarter, and it has a 3:1 lead over its rival in the $6 billion U.S. fast-food Mexican market.

A decent long-term investment

In the first quarter, McDonald’s Corporation (NYSE:MCD) reported improved SSS of 2.4% in the U.S. led by breakfast, chicken products, and new products like lower-calorie Egg White Delight McMuffin and Premium McWraps.

It has restructured its U.S. menu to prepare for a pipeline of new innovative products while removing the less profitable items. For instance, its new Quarter Pounder burgers replaced the Angus Third Pounders and the Wild Berry Smoothie replaced the Blueberry Pomegranate Smoothie. It also added new thick-cut, applewood-smoked bacon to the Quarter Pounder builds, making for a great eating experience. These changes reflect McDonald’s Corporation (NYSE:MCD) focus back on its core menu as well as offering healthy items to its customers.

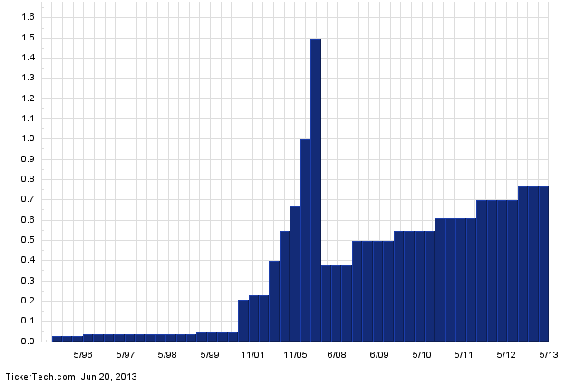

McDonald’s Corporation (NYSE:MCD) has a strong history of paying and increasing its dividend. According to a DividendRank report, it is one of the top 25 safe dividend stocks; in the last two decades, it never lowered or missed a dividend payout and gives shareholders a continuous source of revenue. In September 2012, it hiked the payout by 10%, bringing the annual dividend yield to 3.10%. It has a beta of just 0.35, which indicates the stock is less volatile than the market as a whole. The price to earnings ratio of 18.38 is below the restaurant industry average of 48.03, showing the stock has strong potential to grow.

Dividend History of McDonald’s

Showing signs of improvement

Yum! Brands, Inc. (NYSE:YUM) reported mixed results in its recent second-quarter earnings. Revenue of $2.904 billion was less than the expected $2.92 billion, but EPS of $0.56 beat analysts’ expectations of $0.54. Its China SSS are recovering, especially at KFC, which covers 75% of the 6,000 Yum! Brands, Inc. (NYSE:YUM) restaurants in China.

KFC sales in China have fallen since December due to safety violations among KFC’s chicken suppliers coupled with a series of avian flu cases in the spring. However, this pressure has eased to a 10% SSS drop in June, from 19% in May and 29% in April. I expect this pressure to continue to reduce in the fourth quarter with strong a bounce-back year in 2014.

The company is doing well in its U.S. operation where its SSS increased 1% due to a 2% growth at Taco Bell, driven by its innovative products, Doritos Locos Tacos and Cantina Bell. Taco Bell currently contributes about 60% of the company’s U.S. operating profit, and therefore it will open around 80 new restaurants by the end of 2013. The company sold 100 million Doritos Locos Tacos during the second quarter, and it continues to be one of the most successful new product launches in Taco Bell’s history.

Investors take

New growth ideas like ShopHouse, catering, and increased alcohol sales will help Chipotle Mexican Grill, Inc. (NYSE:CMG) to increase its SSS. McDonald’s Corporation (NYSE:MCD) looks promising due to improved SSS in the U.S. and strong dividend history. Recovery in KFC’s SSS in China and continued growth from Taco Bell in the U.S. makes Yum! Brands, Inc. (NYSE:YUM) an attractive option for your portfolio.

I recommend buying Chipotle Mexican Grill, Inc. (NYSE:CMG), McDonald’s, and Yum! Brands, Inc. (NYSE:YUM) for long-run growth.

Ranu Devi has no position in any stocks mentioned. The Motley Fool recommends Chipotle Mexican Grill, Inc. (NYSE:CMG) and McDonald’s. The Motley Fool owns shares of Chipotle Mexican Grill and McDonald’s Corporation (NYSE:MCD).

The article Perk up Your Portfolio With These Restaurant Companies originally appeared on Fool.com.

Ranu is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.