Is Nordion Inc (USA) (NYSE:NDZ) a buy here? Money managers are taking a bearish view. The number of bullish hedge fund positions decreased by 1 recently.

Equally as integral, bullish insider trading activity is a second way to parse down the marketplace. As the old adage goes: there are many incentives for an upper level exec to get rid of shares of his or her company, but just one, very clear reason why they would initiate a purchase. Several academic studies have demonstrated the valuable potential of this strategy if you understand where to look (learn more here).

Now, we’re going to take a gander at the latest action encompassing Nordion Inc (USA) (NYSE:NDZ).

How have hedgies been trading Nordion Inc (USA) (NYSE:NDZ)?

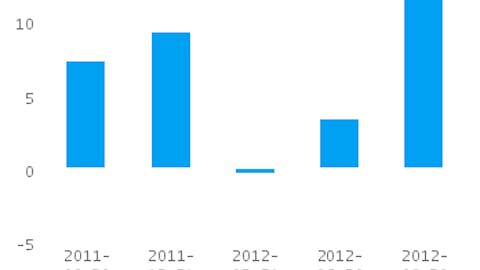

At year’s end, a total of 16 of the hedge funds we track were bullish in this stock, a change of -6% from the previous quarter. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly.

Of the funds we track, Christian Leone’s Luxor Capital Group had the biggest position in Nordion Inc (USA) (NYSE:NDZ), worth close to $40 million, accounting for 1.4% of its total 13F portfolio. On Luxor Capital Group’s heels is Matt Sirovich and Jeremy Mindich of Scopia Capital, with a $31 million position; 0% of its 13F portfolio is allocated to the company. Some other hedge funds that are bullish include Jonathan Savitz’s Greywolf Capital Management, Christopher R. Hansen’s Valiant Capital and Ryan Schaper’s Point Lobos Capital.

Because Nordion Inc (USA) (NYSE:NDZ) has witnessed falling interest from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedge funds that decided to sell off their positions entirely at the end of the year. Intriguingly, Spencer M. Waxman’s Shannon River Fund Management dumped the largest stake of the 450+ funds we monitor, totaling close to $4 million in stock., and Kevin Kotler of Broadfin Capital was right behind this move, as the fund dumped about $1 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 1 funds at the end of the year.

What have insiders been doing with Nordion Inc (USA) (NYSE:NDZ)?

Bullish insider trading is most useful when the company we’re looking at has seen transactions within the past 180 days. Over the latest 180-day time period, Nordion Inc (USA) (NYSE:NDZ) has experienced zero unique insiders purchasing, and zero insider sales (see the details of insider trades here).

Let’s also examine hedge fund and insider activity in other stocks similar to Nordion Inc (USA) (NYSE:NDZ). These stocks are TearLab Corporation (NASDAQ:TEAR), China Cord Blood Corp (NYSE:CO), Bio-Reference Laboratories Inc (NASDAQ:BRLI), Trius Therapeutics, Inc. (NASDAQ:TSRX), and Novadaq Technologies Inc. (NASDAQ:NVDQ). This group of stocks are the members of the medical laboratories & research industry and their market caps are closest to NDZ’s market cap.

| Company Name | # of Hedge Funds | # of Insiders Buying | # of Insiders Selling |

| TearLab Corporation (NASDAQ:TEAR) | 3 | 0 | 0 |

| China Cord Blood Corp (NYSE:CO) | 3 | 0 | 1 |

| Bio-Reference Laboratories Inc (NASDAQ:BRLI) | 10 | 0 | 2 |

| Trius Therapeutics, Inc. (NASDAQ:TSRX) | 8 | 0 | 1 |

| Novadaq Technologies Inc. (NASDAQ:NVDQ) | 9 | 0 | 0 |

With the results shown by Insider Monkey’s tactics, retail investors must always keep an eye on hedge fund and insider trading activity, and Nordion Inc (USA) (NYSE:NDZ) shareholders fit into this picture quite nicely.

Click here to learn more about Insider Monkey’s Hedge Fund Newsletter

Insider Monkey’s small-cap strategy returned 37% between September 2012 and March 2013 versus 12.9% for the S&P 500 index. Try it now by clicking the link above.