Chesapeake Energy Corporation (NYSE:CHK) has recently reported that it would sell its 50% interest in an oil and natural gas field Mississippi Lime to China’s Sinopec for more than $1 billion. Right after the announcement, Chesapeake dropped by nearly 7% to $19.10 per share. Will the sale benefit Chesapeake? Is Chesapeake an investment opportunity when its shares have recently tanked?

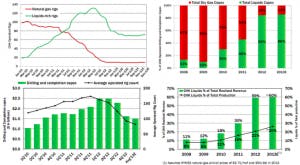

Chesapeake Energy Corporation (NYSE:CHK) is considered to be the second largest natural gas producer in the US, only behind Exxon Mobil Corporation (NYSE: XOM). The company had around 19.6 trillion cubic feel equivalent of proved reserves in 15 million net acres of leasehold in total, while ExxonMobil had nearly 26.7 trillion cubic feet equivalent. Previously, Chesapeake Energy Corporation (NYSE:CHK) announced that it would sell its non-core assets to focus on profitable “core of the core” drilling area. Last year, the company sold up to $12 billion of non-core assets, and it targeted another $5 -$7 billion more this year. In the past 5 years, it has shifted its investment significantly to liquid plays for much higher returns. In 2008, only 13% of its total capital was invested in liquids, while 87% was invested in dry gas. In 2012, the situation was reversed–84% of the total capital was invested in liquids, whereas only 16% went to dry gas.

Source: Chesapeake’s presentation

The revenue from liquids has grown dramatically, accounting for 59% of the company’s total realized revenue in 2012, whereas total liquids production represented 21% of the total production.

Chesapeake Energy Corporation (NYSE:CHK) seems to be reasonable in its operation. As of December 2012, it had nearly $17.9 billion in its total stockholders’ equity, $287 million in cash, and nearly $12.6 billion in short and long-term debt. The average maturity is around 5.3 years. The majority of its debt would be due in 2017, with the principal of nearly $4.3 billion. The debt amount due this year is only $464 million.

Sinopec’s Deal

Sinopec will buy a 50% stake in Chesapeake’s 850,000 net acres of Mississippi Lime for more than $1 billion. Mississippi Lime was reported to have around 850 billion cubic feet equivalent of proved reserves and had an average production of 34,000 barrels a day of oil and gas in the fourth quarter. Steven Dixon, Chesapeake’s COO, commented: “We are excited to announce the execution of our Mississippi Lime joint venture with Sinopec, which moves us further along in achieving our asset sales goals and secures an excellent partner to share the capital costs required to actively develop this very large, liquids-rich resource play.” As China has a huge shale oil/gas reserves, Laban Yu, a Jefferies analyst in Hong Kong, thought that Sinopec cared more about drilling and shale-fracking technology.

Peer Comparison

Chesapeake is trading at around $19.10 per share, with a total market cap of $12.70 billion. The market is valuing the company at nearly 5.6x EV/EBITDA. Another Chesapeake Energy Corporation (NYSE:CHK) peer, Anadarko Petroleum Corporation (NYSE:APC), is a much bigger company with $39.3 billion in total market cap. At $78.60 per share, Anadarko is trading a bit more expensively at 6.7x EV/EBITDA. Anadarko had around 2.5 billion BOE in total proved reserves, including 8.4 trillion cubic feet natural gas. Recently, Global Hunter Securities has increased its target price for Anadarko from $107 per share to $110 per share, a 40% premium on its current trading price. ExxonMobil is the largest company among the three, with nearly $395 billion in total market cap. At $87.70 per share, ExxonMobil is valued the cheapest, at 4.17x EV/EBITDA. It is also paying the highest dividend yield to shareholders, at 2.6%, while the dividend yields of Chesapeake and Anadarko are 1.7% and 0.4%, respectively.

My Foolish Take

Chesapeake Energy Corporation (NYSE:CHK), with its huge proved reserves in natural gas, could be considered an opportunistic play on its natural gas asset. The come back of natural gas prices could potentially drive the company’s share price much higher in the near future.

The article Chesapeake Energy is an Opportunistic Buy originally appeared on Fool.com and is written byAnh Hoang.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.