The past decade has seen a renaissance in U.S. natural gas production, as the application of horizontal drilling and hydraulic fracturing has allowed energy companies to tap the nation’s vast reserves of shale gas, leading to a massive glut of the commodity.

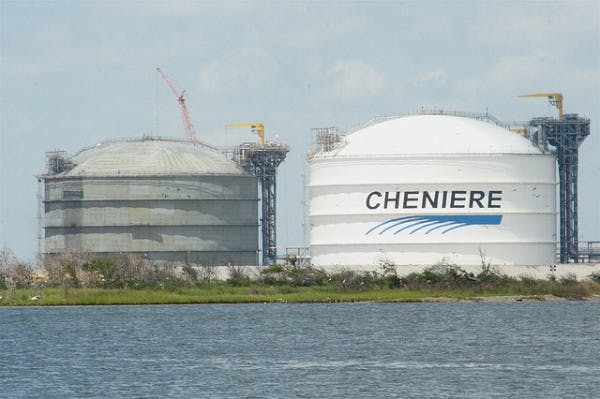

One way of taking advantage of America’s cheap and plentiful natural gas is by exporting it to foreign markets, where it commands higher prices. But so far, only one company, Cheniere Energy, Inc. (NYSEAMEX:LNG), has received approval to export liquefied natural gas, or LNG, to countries that don’t have a free trade agreement with the United States. And in any case, even if more companies win approval to export LNG, it will probably be at least another few years before these exports start to gain traction.

All about GTL

The GTL process entails converting natural gas to higher-value petroleum distillates, including diesel, naphtha, and lubricant base oils. Central to the process is a chemical reaction known as the Fischer-Tropsch process, which uses a catalyst to synthesize carbon monoxide and hydrogen into synthetic fuels.

German scientists developed the technology to convert natural gas into liquid fuels back in the 1920s, though it failed to gain widespread popularity because of exorbitantly high costs. Even today, despite the major incentive that America’s vast reserves of cheap and plentiful natural gas provide, investment in GTL technology remains minor.

Just a handful of plants around the world operate commercially, mainly in Qatar, South Africa, and Malaysia. Combined, they produce a relatively insignificant 200,000 barrels of fuels and lubricants a day — less than 1% of worldwide diesel demand.

Major hurdles for GTL ventures

High capital costs are still the largest barrier for most potential entrants. Though several major companies showed interest in GTL technology in the late 1990s after Syntroleum, an Oklahoma-based company focused on developing renewable synthetic fuels, reported progress in bringing expenses down, costs have instead escalated substantially since then.

According to some estimates, capital costs are now as much as 10 times as high as they were a decade ago. Royal Dutch Shell‘s Pearl project in Qatar, currently the world’s largest GTL facility, serves as the most powerful reminder of this trend.

Pearl, located in the industrial city of Ras Laffan, is the result of a joint effort by Qatar Petroleum and Shell. The facility was designed to produce various products via the GTL process, including diesel, naphtha, kerosene, and lubricant oils, as well as condensates and liquefied petroleum gas.

Through the third quarter of last year, Pearl had produced nearly 6 tons of natural gas liquids and other products using the GTL process. Initially, the economics of the facility appeared highly attractive because of high oil prices and the fact that Qatar, like the U.S., possesses cheap and plentiful natural gas.

But the project has encountered several unanticipated hurdles along the way, the most serious of which has been a massive escalation in costs. Shell initially estimated Pearl to cost around $5 billion. But toward the completion of the facility, that estimate soared to $19 billion. In addition, the plant has been plagued with a host of maintenance issues, which have kept it from operating at full capacity.

As Pearl’s example illustrates, GTL facilities are still prone to massive cost overruns and unexpected delays, which can seriously threaten the economics of such projects. Despite these challenges, however, a few companies remain undeterred and are investing billions in GTL technology.

Sasol Limited (ADR) (NYSE:SSL) enters the GTL arena

In December, South African energy company Sasol Limited (ADR) (NYSE:SSL) announced that it will construct the first commercial facility in the U.S. to convert natural gas to liquids such as diesel and jet fuel. When completed, Sasol’s plant will be the second-largest GTL facility in the world, after Shell’s Pearl plant.

The Johannesburg-based company has extensive experience in GTL technology and has already completed GTL facilities in Qatar and South Africa. Its newest plant, expected to cost between $11 billion and $14 billion, will be located in Louisiana, a state with ample shale gas fields.

Sasol’s Louisiana facility will consist of the three main units necessary to convert natural gas into liquids — a chemical plant, a gas processing plant, and a refinery. The company has said it hopes to produce nearly 100,000 barrels of fuel daily and expects production to commence in 2018.

Profitability constraints and final thoughts

For GTL ventures like Sasol’s proposed plant to be profitable, natural gas prices must remain low relative to diesel and jet fuel prices for an extended period of time — an unlikely proposition.

When natural gas prices were under $3 per Mcf, financing GTL projects was relatively attractive. But prices have already started to rise and are unlikely to dip below $2 or $3 per Mcf anytime soon, which raises serious questions about the economics of even the most efficient GTL facilities.

At current gas prices of around $4 per Mcf, GTL plants need diesel prices to be well above $4 a gallon to make the conversion process economical. If prices rise above $5 and $6 per Mcf over the next few years, it’s difficult to envision a scenario where diesel and jet fuel prices see commensurate increases.

Furthermore, there are some important differences between the U.S. natural gas market and foregin markets. In Qatar, for instance, natural gas prices are subsidized and regulated, whereas the U.S. gas market is entirely unregulated.

With some commentators suggesting that at least a 25-year period of sustained low gas prices is required for GTL facilities to be economical, I suspect that U.S. investment in GTL is likely to remain minimal for the foreseeable future.

The article Could Turning Natural Gas Into Liquids Be the Next Big Thing? originally appeared on Fool.com.

Fool contributor Arjun Sreekumar has no position in any stocks mentioned. The Motley Fool recommends Sasol and has options on Chesapeake Energy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.