A recent article in the Financial Times reported that President Barack Obama stated that by 2020, the United States was likely to be a net exporter of natural gas. Currently, the US is one of the largest importers of natural gas, eclipsed only by Japan. However, with the recent explosion in fracking throughout the US, there is a growing push to send this bounty abroad. There will be many beneficiaries of more open policy on natural gas exports.

Operators

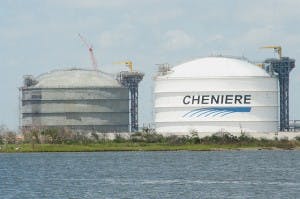

According to the Financial Times, the Department of Energy is currently reviewing applications for new liquefied natural gas (LNG) terminals and there is an expectation that one in Texas will be approved soon. Among LNG terminal operators, Cheniere Energy, Inc. (NYSEAMEX:LNG) is the first name on the list.

Cheniere currently owns and operates the Sabine Pass LNG receiving terminal as well as a related pipeline. Due to anticipated demand, Cheniere is developing a liquefaction facility near the existing re-gasification facilities at Sabine Pass and is developing a liquefaction project near Corpus Christi, Texas, as well.

Build it and it will flow

Before Cheniere Energy, Inc. (NYSEAMEX:LNG) can start moving natural gas exports, terminals must be built. As demand for new terminals builds, Foster Wheeler AG (NASDAQ:FWLT) should be presented with ample bidding opportunities.

Winning bids for such projects is a difficult and time-consuming process. It will be an uphill battle for Foster Wheeler as it faces competition from tough competitors like one of the largest construction firms in the United States, privately-held Bechtel. Bechtel is currently engaged in the construction of the Cheniere Energy, Inc. (NYSEAMEX:LNG) Sabine Pass liquefaction facility.

Foster Wheeler AG (NASDAQ:FWLT) has extensive experience in various types of energy projects, but would not be a pure play on LNG. In addition to the construction of LNG projects, Foster Wheeler is also involved in the heavy construction of other projects including refining, petrochemicals, pharmaceuticals, power generation and many others.

Getting it where it needs to go

Once the terminals are built and natural gas has been processed for shipment, it must be transported by sea to foreign markets. Golar LNG Limited (USA) (NASDAQ:GLNG) has a long history of serving the natural gas industry on the open seas. The Bermuda-incorporated company owns a fleet of thirteen LNG transport vessels as well as four floating storage and re-gasification units (FSRU). Golar LNG Limited (USA) (NASDAQ:GLNG) expects to have four new LNG units delivered before the end of 2013, and a fifth FSRU unit will available during the fourth quarter of this year.

In addition to delivering the world’s first FSRU in 2008, Golar is now actively pursuing projects involving floating liquefaction to convert pipeline quality natural gas. The projects are focused on providing a lower cost and quicker lead time alternative to land based LNG facilities.

Winners

The United States has very cheap and abundant natural gas. It would make sense to encourage the export of this valuable commodity. There will be many beneficiaries to natural gas exports in addition to those mentioned above. Natural gas producers will benefit from higher prices and increased production, while pipeline operators should see increased flows leading to the construction of additional pipeline capacity. Europe and Asia should see some relief from the high prices currently paid today, which could boost those economies. Finally, the US government will take its piece of the pie as well and should gain additional political leverage over net importers of natural gas.

The article Beneficiaries of U.S. Natural Gas Exports originally appeared on Fool.com and is written by Alex Gray.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.