Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves.

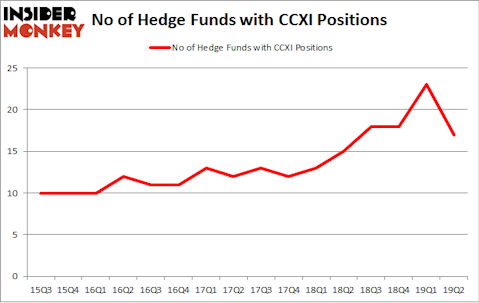

Is ChemoCentryx Inc (NASDAQ:CCXI) undervalued? The best stock pickers are taking a bearish view. The number of long hedge fund bets were trimmed by 6 recently. Our calculations also showed that CCXI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the key hedge fund action regarding ChemoCentryx Inc (NASDAQ:CCXI).

How have hedgies been trading ChemoCentryx Inc (NASDAQ:CCXI)?

At the end of the second quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -26% from the first quarter of 2019. On the other hand, there were a total of 15 hedge funds with a bullish position in CCXI a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Bihua Chen’s Cormorant Asset Management has the largest position in ChemoCentryx Inc (NASDAQ:CCXI), worth close to $22 million, comprising 1.3% of its total 13F portfolio. Sitting at the No. 2 spot is Farallon Capital, with a $18.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other peers that hold long positions comprise Mitchell Blutt’s Consonance Capital Management, Renaissance Technologies and Mark Lampert’s Biotechnology Value Fund / BVF Inc.

Because ChemoCentryx Inc (NASDAQ:CCXI) has witnessed bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of hedgies that decided to sell off their positions entirely in the second quarter. It’s worth mentioning that Michael Castor’s Sio Capital cut the biggest investment of the 750 funds watched by Insider Monkey, valued at close to $7.4 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund said goodbye to about $5.6 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 6 funds in the second quarter.

Let’s now review hedge fund activity in other stocks similar to ChemoCentryx Inc (NASDAQ:CCXI). We will take a look at Resources Connection, Inc. (NASDAQ:RECN), Blue Bird Corporation (NASDAQ:BLBD), Simulations Plus, Inc. (NASDAQ:SLP), and Overstock.com, Inc. (NASDAQ:OSTK). This group of stocks’ market values are closest to CCXI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RECN | 13 | 39849 | -1 |

| BLBD | 5 | 65736 | -1 |

| SLP | 9 | 32263 | 3 |

| OSTK | 9 | 13457 | -4 |

| Average | 9 | 37826 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $92 million in CCXI’s case. Resources Connection, Inc. (NASDAQ:RECN) is the most popular stock in this table. On the other hand Blue Bird Corporation (NASDAQ:BLBD) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks ChemoCentryx Inc (NASDAQ:CCXI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CCXI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CCXI were disappointed as the stock returned -27.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.