At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Is Century Aluminum Co (NASDAQ:CENX) worth your attention right now? Investors who are in the know are definitely taking a bullish view. The number of bullish hedge fund bets that are revealed through the 13F filings rose by 3 in recent months. There were 15 hedge funds in our database with CENX positions at the end of the 2016 third quarter. At the end of this article we will also compare CENX to other stocks including Viate Pharmaceuticals Inc (NASDAQ:VTAE), SunOpta, Inc. (USA) (NASDAQ:STKL), and Blackrock Kelso Capital Corp. (NASDAQ:BKCC) to get a better sense of its popularity.

Follow Century Aluminum Co (NASDAQ:CENX)

Follow Century Aluminum Co (NASDAQ:CENX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

With all of this in mind, we’re going to check out the key action surrounding Century Aluminum Co (NASDAQ:CENX).

How have hedgies been trading Century Aluminum Co (NASDAQ:CENX)?

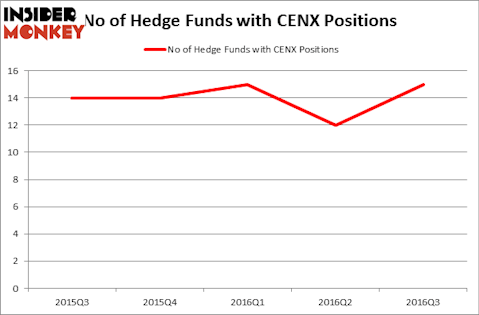

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a boost of 25% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards CENX over the last 5 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Chuck Royce’s Royce & Associates has the most valuable position in Century Aluminum Co (NASDAQ:CENX), worth close to $9.8 million. The second most bullish fund manager is D. E. Shaw’s D E Shaw which holds a $7.7 million position. Remaining professional money managers that hold long positions include Jonathan Auerbach’s Hound Partners, Robert Bishop’s Impala Asset Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. We should note that Impala Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.