What’s the fastest growing drug in Celgene Corporation (NASDAQ:CELG)‘s portfolio? It isn’t Revlimid, Vidaza, or Abraxane. All three of those drugs are experiencing strong sales, but none can match the growth rate of Istodax. In this round of our continuing series on Celgene’s products and pipeline, we’ll take a look at this fast-growing but still-lagging drug.

First came dirt. In 1994, Japanese researchers with Fujisawa Pharmaceutical first announced discovery of a molecule that they called romidepsin. The molecule was isolated from bacteria found in a soil sample from Yamagata Prefecture in Japan. As the researchers experimented with romidepsin, they discovered that it possessed the ability to kill cancer cells.

Privately held Gloucester Pharmaceuticals licensed romidepsin, also known as FK228 and depsipeptide, from Fujisawa in 2004. Gloucester advanced the drug into late-stage studies, renaming it as Istodax. The U.S. Food and Drug Administration approved Isotdax in November 2009 as a second-line treatment for cutaneous T-cell lymphoma, or CTCL.

Celgene didn’t wait long to enter the picture. One month after the FDA approval, the company announced plans to buy Gloucester. The deal closed in January 2010 for $340 million, plus up to $300 million more if Istodax met certain milestones. Celgene soon began selling the drug and pursued FDA approval for its use in treating peripheral T-cell lymphoma, or PTCL. The company also filed for European regulatory approval for PTCL.

Istodax sales started off slowly. However, things began to pick up somewhat after the FDA granted accelerated approval for Istodax as a second-line treatment for PTCL in mid-2011.

Source: Company 10K.

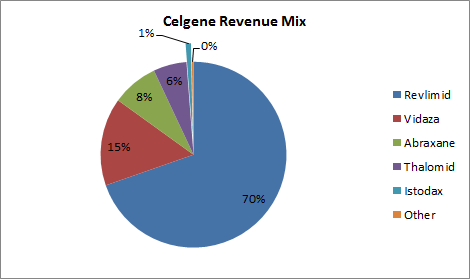

The growth rates over the past three years were nice and made Istodax the company’s fastest-growing product. Celgene has begun to see a return on its investment in Gloucester, but the crown jewel that it acquired from the smaller company still isn’t making much of a dent on total revenue.

Source: Company 10K.

Euro no good — and other challenges

One reason why Istodax sales haven’t taken off even more quickly is Europe. The European Committee for Medicinal Products for Human Use, or CHMP, announced a negative recommendation for the drug in July 2012 for treating PTCL. Celgene requested a re-examination of this opinion, but CHMP confirmed the negative recommendation in November.

The problem relates to proving the clinical benefit of Istodax. The FDA’s accelerated approval for the drug in treating PTCL was based on response rate rather than improved survival rates or other clinical benefits. Without additional studies to convince CHMP, Istodax’s European future doesn’t look good.

Celgene’s management didn’t even mention Istodax in the company’s fourth-quarter earnings call and doesn’t show any other studies for the drug on its pipeline. However, the U.S. National Institutes for Health lists one phase 1/2 study for the drug sponsored by Celgene.

Other challenges for Istodax include competition, primarily from Spectrum Pharmaceuticals, Inc. (NASDAQ:SPPI) . Spectrum picked up Folotyn, which is approved in the U.S. for PTCL, with its acquisition last year of Allos Therapeutics. The company also has a late-stage trial under way for belinostat targeting treatment of PTCL.

Onyx Pharmaceuticals, Inc. (NASDAQ:ONXX) could be a longer-term threat. The company is collaborating with Northwestern University on a phase 1 trial of carfilzomib in treating CTCL.

Looking ahead

Don’t look for Istodax to ever become the blockbuster that Revlimid is or that Vidaza and Abraxane probably will be. However, it wouldn’t be surprising to see the drug top $100 million in annual sales within the next couple of years. That’s not bad, but Istodax likely won’t grow to more than a small slice in Celgene’s revenue pie.

The article Celgene’s Fastest-Growing Drug originally appeared on Fool.com and is written by Keith Speights.

Fool contributor Keith Speights has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.