We recently published a list of 12 AI Updates Worth Taking a Look At. In this article, we are going to take a look at where Celestica Inc. (NYSE:CLS) stands against other AI stocks worth taking a look at.

AI’s Expanding Role in Carbon Up-Valuing and Biopharma Development

In a Bloomberg interview, SandboxAQ CEO Jack Hidary started discussing the company’s partnership with Saudi Aramco, which focuses on using AI to convert carbon emissions into valuable products. Unlike language models trained on internet data, SandboxAQ develops large quantitative models (LQMs) that specialize in chemistry and physics, making them suitable for industries such as petrochemicals and pharmaceuticals.

Hidary explained that Aramco, as one of the world’s most valuable companies, can improve its market value not just by increasing production but by converting carbon emissions into high-value materials. For example, AI-driven chemical processes can transform carbon into composites used in the automotive industry to make vehicles lighter and more efficient. The shift from traditional carbon capture and storage to carbon capture and up-valuing represents a anew approach to sustainability, turning emissions into useful resources rather than simply storing them underground.

Moreover, Hidary emphasized AI’s broader economic impact, predicting that AI-driven innovations will contribute to deflationary trends by lowering costs in sectors like energy storage, housing, agriculture, and manufacturing. He noted that while inflation is a short-term concern, AI’s influence on business-to-business applications will significantly drive down costs over the next several years.

Hidary also discussed future expansion as SandboxAQ sees strong potential in the Gulf region, where governments are actively embracing AI across different sectors. Hidary pointed out that countries like Saudi Arabia, the UAE, and Bahrain possess valuable genomic and medical data, which could enable them to develop their own biopharma assets rather than relying on imported medicines and diagnostics. By using AI-powered LQMs, these nations could create homegrown pharmaceutical innovations to address regional health concerns and contribute to the global biotech industry.

For this article, we selected AI stocks by reviewing news articles, stock analysis, and press releases. We listed the stocks in ascending order of their hedge fund sentiment taken from Insider Monkey’s Q4 database of over 1000 hedge funds.

At Insider Monkey we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

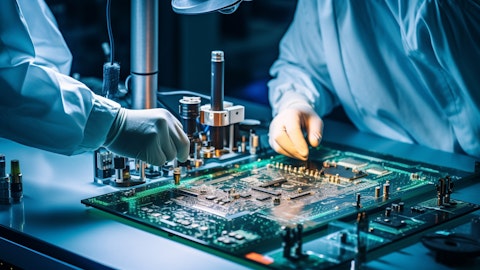

A close-up of a circuit board with components depicting the intricate electronic componentry products the company produces.

Celestica Inc. (NYSE:CLS)

Number of Hedge Fund Holders: 44

Celestica Inc. (NYSE:CLS) provides supply chain solutions, manufacturing, and hardware platform services across various industries in North America, Europe, and Asia.

On February 21, JPMorgan initiated coverage on Celestica Inc. (NYSE:CLS) with an Overweight rating and a $166 price target for December 2025. The firm sees the company benefiting from AI infrastructure investments, particularly in custom ASIC servers and white box switches, due to its strong ties with major hyperscalers. Celestica Inc. (NYSE:CLS)’s higher R&D spending, around 1% of revenue compared to peers below 0.5%, is expected to drive revenue growth in higher-margin businesses within its HPS portfolio. The shift could lead to a valuation re-rating as investors recognize the potential for stronger earnings beyond the medium-term growth outlook.

Overall, CLS ranks 5th on our list of AI stocks worth taking a look at. While we acknowledge the potential of CLS as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than CLS but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.